The Do's and Don'ts to have Crypto Success

After you have been in the crypto market for a significant amount of time, you begin seeing trends. You begin seeing what people who have success in the crypto market usually do, and also what those who lose everything tend to do as well. While there are always exceptions to the rule, you begin to notice that it isn’t always the experienced investors who have the most success. Or even those who begin with the most money. It is those who stick to the basics, following the advice of those who had success before, so that you don’t make the same mistakes that they did.

By just following these simple tips on what to do and not do, you will significantly increase your chances of having success in the crypto market.

- Don’t FOMO

One of the worst things you can do in the crypto market is to invest or sell with FOMO. The urge to buy crypto that has skyrocketed in value can be intense. But it is important to remember that by the time you begin feeling FOMO to invest in a certain crypto, usually, it has reached its peak in the short. The same goes for selling. When you feel you need to sell a coin that has plummeted in value. That usually means its short-term bottom is in. Instead, it is better to buy during the price drops or quiet times of the market. The goal should always be to accumulate during the bear market. We want to build our portfolio before prices rise, not while they are rising. Build your success during the bear market, and enjoy it during the bull market.

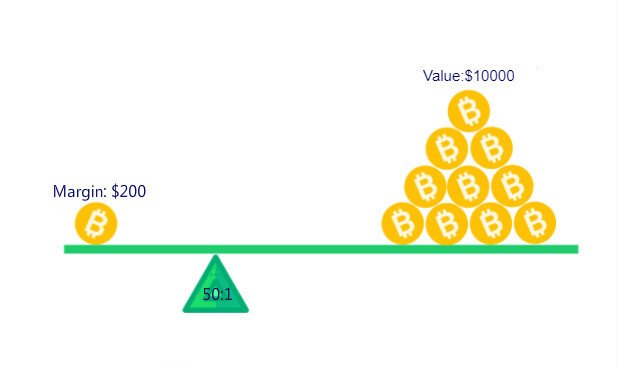

2. Don’t Trade With Leverage

While it is true that people have become rich overnight by trading with leverage. We must admit that you and I aren’t that likely. We are more likely to get liquidated and lose everything. There is no worse feeling than having your crypto position liquidated and I wouldn’t wish that feeling on anyone.

Instead, the best option is to build slowly. Just like the Tortoise and the Hare story. Slow and steady wins the race.

3. Don’t Trust Anyone

The crypto market is like the Wild West and anything can happen. There is danger lurking all around you, and you need to be careful to ensure your survival in this market. If an offer sounds too good to be true, that means it is likely a scam. All of those advertisements offering to send you back double the amount of BTC or ETH that you send them are scams.

Aside from that, you should also never trust influencers on YouTube, Twitter, or anywhere in the crypto market. More often than not they have their own ulterior motives. Perhaps they were paid to talk about a coin that they have no faith in. Or maybe they are trying to pump and dump a token. Unfortunately, with many of the influencers their main concern is their own wallets and not the well-being of their audience.

4. Do Invest in the “Real” Projects

While there may be short-term gains to be had on low-cap cryptocurrencies. As the market matures, so will the values of these “junk” tokens. Projects that are memes, and have no real use-case or value will eventually stop being connected with Bitcoin’s price movements and will trend to zero.

Instead, we should be investing in the real projects of the cryptocurrency market. The blue chips such as Bitcoin or Ethereum. Projects that have a real use case such as Uniswap or Chainlink. Or even projects that are trying to do something incredibly ambitious and different from the rest of crypto such as ICP. There are so many Layer 1 copycat chains, meme tokens, and other projects that will eventually fall away by the wayside. We need to invest in the projects that will be here for the long term.

5. Don’t Have a Short Time-Frame

Having a short-term mindset is one of the worst things that you can do in the crypto market. It will cause you to stress over daily price fluctuations, and look focus on what is really important. Building.

Not only that, but the crypto market tends to move in cycles. Those who buy and hold for a longer duration of time, tend to be the biggest winners in this market. Those who are buying with hopes of quick riches, tend to sell low and buy back higher. Be patient, and think in the long term.

6. Don’t Invest More than you can Afford to Lose

This is perhaps the most important tip for not only investing in the cryptocurrency market but investing in general. If you are investing so much money that price movements are stressing you out, or you begin to worry about being able to pay for the essentials such as rent, food, or gas. Then you are clearly putting too much money into the market.

By doing this, not only will you need to eventually sell your portfolio to pay for your bills. But it's likely you will need to do it at a loss. While we all want to become rich by investing in crypto. It's important that we always remember what is the most important. Food, health, safety, and taking care of ourselves and our family.

7. DCA on a Regular Basis

While you should never invest more than you can afford to lose, it is important to continue investing in this market. We are currently in perhaps the coldest portion of the crypto bear market. During times like this, it can be very difficult to maintain conviction and continue buying. In fact, our brains will likely be telling ourselves that we are crazy.

However, in crypto’s short history, it is those who buy when everything seems to be the bleakest, that find the most success. Those who bought during the bear market bottom of 2018. Those who bought during the covid price crash of March 2020. And those who are buying now. Being greedy when others are fearful, and being fearful while others are greedy.

8. Spend Time Keeping up to date on the Industry

Spending time keeping up to date on the crypto industry is one of the most important things you can do to have success. You almost need to treat it as your daily habit or part-time job. Not only could it save you from disaster, but seeing the rumors about companies such as FTX, Celsius, or BlockFi having financial troubles. But it could help you to find the next big opportunity in the space.

9. Be Curious. Experiment

By keeping that childlike curious mindset and exploration, you will be surprised by how much it increases your chances at being successful. Often times by just showing up and experimenting, you will be able to qualify for crypto airdrops. Some of these airdrops have been for several thousands of dollars.

Also, it will help you to able to make connections in this industry. You never know who may be watching, or who you may become friends with. It might even help you land your next job. While in the previous generation LinkedIn was one of the prerequisites to finding jobs. I have seen countless people land jobs just from being active in the crypto community.

All of the tips in this article are quite basic, but you would be surprised at just how powerful they can be. It could be the difference that makes you successful in the cryptocurrency market.

How about you? What are your recommendations to be successful in the crypto market?

Follow me on Twitter

https://twitter.com/johnwege

Follow me on Medium

https://medium.com/@johnwege

As always, thank you for reading!

Posted Using LeoFinance Beta