Important Dynamics At Play To Understand This Pump

Driving Forces

What drives a price in any direction is always very important to know and understand. Why? Well, it can offer a lot of insight into the reliability of the pump, and whether it has much chance of continuation. Combine these dynamics together with additional data and you generate a clearer picture of the market.

First of all, the current pump falls into the definition of a perfect storm. A perfect storm sees a number of things taking place at the same time that all work in favor of a certain outcome. The following key points have all taken place together, ultimately creating a surge in the Bitcoin price. It’s also important to note how long these “stimulants” can remain a catalyst.

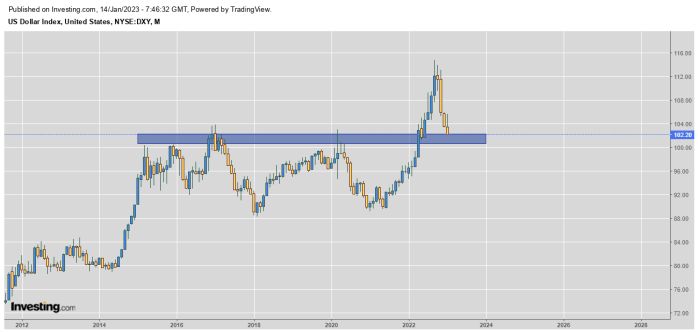

Firstly, we have dollar weakness in the DXY, which can only mean one thing. That’s right if the dollar goes down, it requires more dollars to purchase assets such as Bitcoin and stocks. Inevitably, a weak dollar causes Crypto and stocks to rally, by default. Looking at the graph below suggests that the dollar could be about to experience some short-term relief.

Image Source – Investing.com

Secondly, I addressed tax harvesting in a recent article. This activity usually takes place in January. This implies that sell pressure can increase somewhat during the initial stages of January. However, reduced pressure, once investors have sold their assets will aid to promote upside momentum.

Then there is the case of the CPI print. Coming in on target was a bullish scenario, which helped to kick off this rally. So, in summary: A bullish CPI print is further enhanced by reduced selling pressure from an end to tax harvesting, as well as a collapse in the dollar index. This created the perfect storm to usher in a strong move to the upside. It is important to bear in mind that the stock market benefits equally as much in such a scenario.

Will This Move Be Sustainable?

Isn’t this the most important question? Premature short positions could be fatal if the price were to continue higher. So, what are the hints that the market is currently offering those who know what to look for? One of the most important factors is the stock market. The S&P has now once again moved up to the long-term downward-sloping resistance.

Image Source – Dailyfx.com

This resistance needs to be flipped into support if we wish to see continuation for the S&P. This also means that what takes place over the weekend is now even less significant than usual. If the S&P fails to conquer this level, prices will slip. This will inevitably have a negative impact on Crypto. I still believe that a strong decoupling from stocks will eventually come. However, you can only factor that in once it actually happens.

Bitcoin is currently trading above the 200 EMA, which is rather bullish. However, a weekly close above this level is required in order to provide a continuation to the upside. That being said, even that is not a guarantee, as Bitcoin has closed weekly candles above important levels before, only to later lose the newly acquired ground. However, a positive close will usually be accompanied by even a short-term pump.

In the short term, the volume appears reasonably healthy. However, zoom out a bit and there is a bearish divergence at play: Price is appreciating, while the volume is diminishing. If you are not in a trade, now might not be the best time to enter a new position.

Conclusion

In summary: Bitcoin needs to close the week above the 200 EMA in order to confirm a level of continuation. Secondly, that outcome needs to be considered in light of what the S&P does at this critical level. This is what I am watching and waiting for in order to determine if this rally has legs. Remember, this is a good rally but the long-term downtrend has still not been broken. This is not investment. DYOR and enjoy the ride.

Disclaimer

First of all, I am not a financial advisor. All information provided on this website is strictly my own opinion and not financial advice. I do make use of affiliate links. Purchasing or interacting with any third-party company could result in me receiving a commission. In some instances, utilizing an affiliate link can also result in a bonus or discount.

This article was first published on Sapphire Crypto.

Posted Using LeoFinance Beta

https://twitter.com/1460818780980973570/status/1614249826081800193

https://twitter.com/1331330355513745413/status/1614286130412650498

The rewards earned on this comment will go directly to the people( @hivehotbot, @taskmaster4450le ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Interesting analysis. The market has been moving quite unpredictably,

I thought this same thing at 19k until it went over 20k. However, I’m still sticking to my bias at 25k before making any conclusions

Posted Using LeoFinance Beta

Interesting perspective on the current market situation. I can't wait for the moment crypto decouples from stocks. I think the stock market ties down the crypto market

Congratulations @sapphirecrypto! You received a personal badge!

Thank you for participating in the Leo Power Up day.

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!