Could Bitcoin Have Reached the Dip?

The bearish trend in the crypto markets undoubtedly affects the Bitcoin (BTC) activity in the centralized exchanges. Especially after the bankruptcy of FTX, trust in centralized exchanges decreased significantly. That's why on November 14 last month, a record high BTC outflow took place. Only on November 14, 142,788 BTC were withdrawn from centralized crypto exchanges.

It seems that many cryptocurrencies, not just BTC, have been withdrawn from centralized exchanges (CEX). Last month, nearly $8 billion worth of cryptocurrencies were withdrawn from CEXs in a week. The amount of Bitcoin withdrawn was about $ 3.7 billion, while the amount of Ethereum (ETH) was about $ 2.5 billion. In addition, the US Department of Justice's scrutiny of Binance on the grounds that it facilitates money laundering has caused investors to worry again. Although Binance CEO Changpeng Zhao said it was a FUD, he could not prevent a huge wave of withdrawals. On December 13, nearly $8 billion in outflows took place on Binance. Zhao assured investors that they are coping with customers' demand and are financially stable.

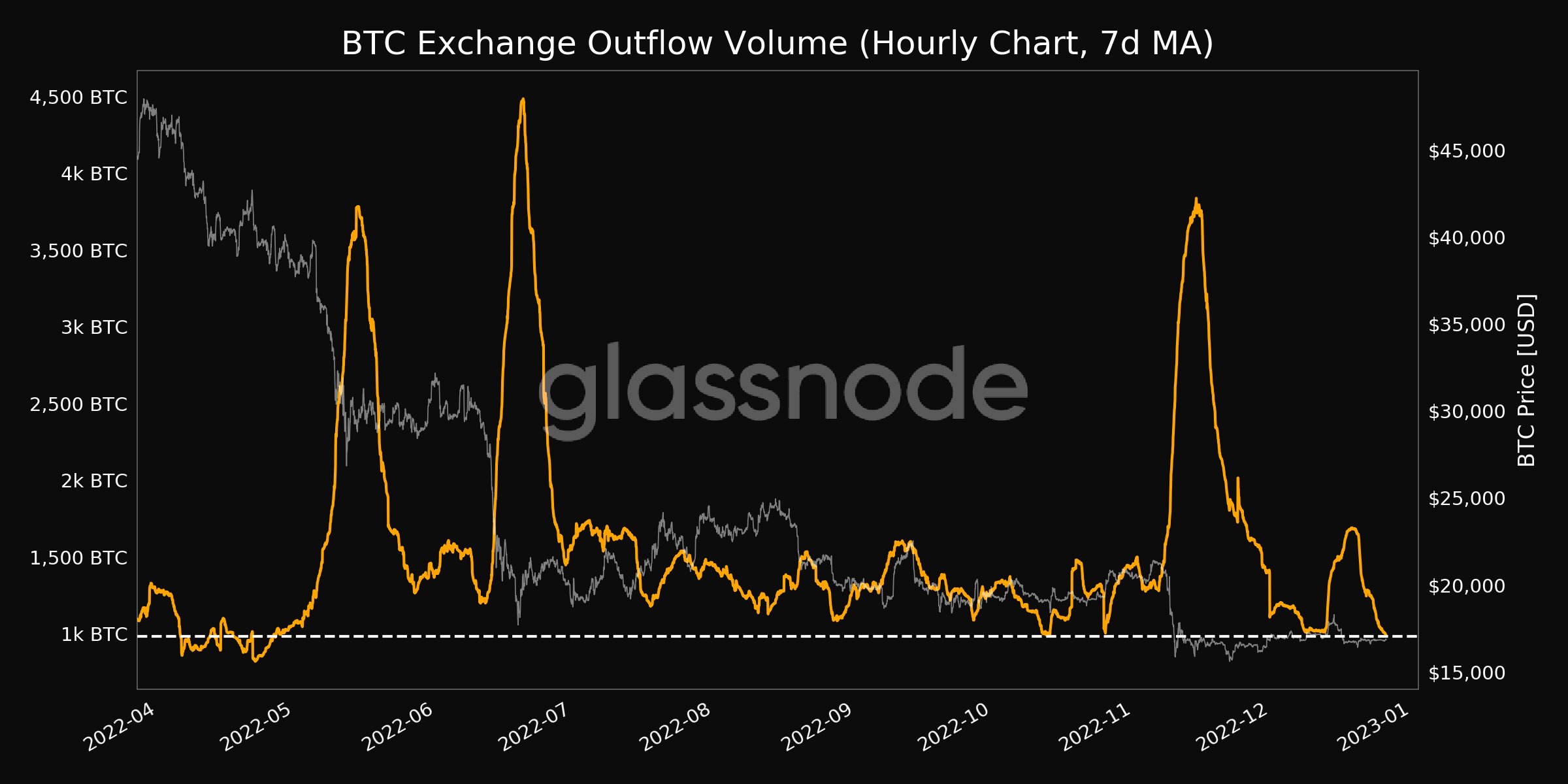

Panic among investors seems to be waning significantly, according to data from Glassnode. BTC outflows volumes have dropped to 986.37 BTC at the seven-day moving average. This is the lowest level since May 2022. Also, BTC outflows from CEXs seem to have decreased by about 93% compared to last month.

These data show that investors, especially those in CEXs, are starting to adapt to market conditions.

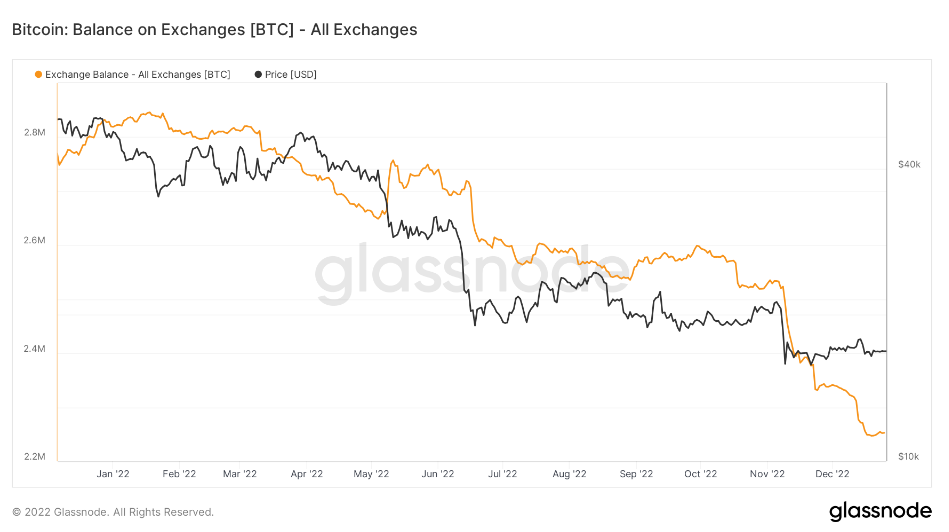

In addition, there are currently 2.252 million BTC balances on CEXs. The balance in January 2021 is 2,845 million BTC. There is a 21% decrease in about a year.

Bitcoin is currently trading at $ 16816. Especially in the last few days, Bitcoin has been charting almost like a Stablecoin. This is truly remarkable. It looks as if it is about to bounce up or down. Frankly, it is not possible to know which direction it will go, but according to the current data, this direction seems to be upwards. But this could also be downwards. Investors' behavior will show this. Obviously, the behavior of investors will decide this direction.

The last few days have been the most sluggish in the crypto markets, which reveals that the recovery process has begun. On the other hand, these data show that the impact of FTX events and the accompanying bankruptcies seems to have decreased significantly. According to these data, the Dip may have been found on the BTC side.

The current chart heralds a bounce in one direction, but it is not possible to know in which direction. We'll wait and see.

Posted Using LeoFinance Beta

https://twitter.com/2952717285/status/1607752629249245184

The rewards earned on this comment will go directly to the people( @rtonline ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.