TIB - An Investors Journal #638 - Specialty Chemicals, Utilities, Steel, IT Services, Waste Management, Bulk Shipping, ASX Stocks + more

Options expiry brings a slew of covered call assignments and LEAPS expiries. Losses on the capital trades in US and profits in Europe as the banks wake from their long slumber. Income trades make for a profitable 30 days cycle and yield enough to pay the month's pension payment

Portfolio News

In a week where S&P 500 dropped 0.66% and Europe rose 0.3%, my pension portfolio dropped 0.28%. Winners were a few Australian resource stocks (gold and lithium), Japan and Tesla (TSLA up 9%).

Big movers of the week were Plexus Holdings (POS.L) (+155%), Honey Badger Silver (TUF.V) (+25%), Pilbara Minerals (PLS.AX) (+14%), Mamiya-OP Co. (7991.T) (+12.3%), Solid Power (SLDP) (+12%). The sparseness of this list tells me it was a breather week.

Plexus move is a complete anomaly with no news flow (124% up in one day). Honey Badger Silver move is also an anaomaly following the stock consolidation last week. Mamiya has been on the top movers list a few times - maybe time to top up a bit.

US markets are becoming nervous about the scale of layoffs amongst the big employers though the job openings number shows the labour market is still a bit tight

Inflation data is softening but headlines like this still have me bothered - whenever is 10.5% inflation something to celebrate

Japan has finally got some inflation - up to 4% - after more than 10 years of stagflation

Crypto Bounce Continues

Bitcoin price pushed higher with a small test 2% lower finishing the week 9% higher than the open - trough to peak range was 14% - less than half of last fortnight

Ethereum chart was almost identical with a trough peak to range a little less 1t 11%

Solana continued its bounce with an open to peak move of 58% - their troubles may be past says the market

Fantom is on a pump with a 25% move from the trough

Have had my eye on Injective Protocol (INJ) but did not buy last week - too bad - pumps 28% vs BTC

Bought

With a large slice of covered calls being assigned this coming week, ran stocks screens looking for replacements - been a while since I did that in Europe

Akzo Nobel N.V. (AKZA.AS): Specialty Chemicals. Dividend yield 2.93%. Wrote covered call for 1.3% premium with 5.1% price coverage. Chart shows break of the downtrend and retest - looking for higher high

ThyssenKrupp AG (TKA.DE): Europe Steel. Dividend yield 2.18%. Wrote covered call for 1.8% premium with 11.5% price coverage. Chart shows break of the downtrend (a lot more choppy) and the formation of a W at the bottom of the cycle. Higher high has been confirmed.

Atos SE (ATO.PA): Europe IT Services. Wrote covered call for 5.06% premium with 5.14% price coverage. The chart shows a classic contrarian trade - this stock has hit hard times and keep falling. There is a clear bottoming process with a distinct inverse head and shoulders (not eh chart is a weekly - not a daily)

Renewi plc (RWI.L): Waste Management. Chart is less compelling with price bounced off a medium term support line and possibly stuck in a ranging pattern. There is 30% headroom to the previous high.

Sunrun Inc (RUN): Solar Power. Added back a small parcel at 11% premium to price assigned in October 2022. Price has made a higher low

Star Bulk Carriers Corp (SBLK): Bulk Shipping. Added back a small parcel at 12% discount to price assigned in February 2022. Price has plumbed down to support since then and is showing signs of breaking out of a 4 month consolidation

ENGIE SA (ENGI.PA): French Utility. Assigned early on the sold leg of a credit spread which is trading TTB at an 11% premium to the €12.59 opening price (Jan 19). Did close out the bought put to bring breakeven down to €12.80 which is 1.67% premium.

Elevance Health Inc* (ELV): US Healthcare. Assigned early on the sold leg of a credit spread which is trading TTB at a 5.2% premium to the $475.36 opening price (Jan 19). Did close out the bought put to bring breakeven down to $488.05 (2.7% premium). I had been debating whether to do this anyway - market decided for me. As it happens AAPLus have added this back to their buy lists (but not at that high price). Last week I had bought a nibble parcel - sold that to get back down to a round number of shares for 0.9% loss

AMN Healthcare Services (AMN): US Healthcare. Assigned at 5.9% premium to $99.14 closing price (Jan 20). Breakeven on this tranche is $102.26 though the series of naked puts have added $1.65 to breakeven (so thinking $106.65 is smarter way to think about the trade). Capital trades and coverd calls have made AMN a solid investment since AAPlus first added it in February 2022.

Invesco Solar ETF (TAN): Solar Power. Exercised on bull call spread at 5.6% discount to $79.47 closing price (Jan 20). Breakeven on this tranche is $73.42 which was part of 75/90/60 call spread risk reversal.

Solar Power has been an on-off investment arena running through the 2019 US Election and through the Inflation Reduction Bill negotiations. It has also been a crap shoot with California and other States adjusting solar rebates. I have had 3 goes at putting in place call spread risk reversals - each one has been fully funded with sold puts. The chart shows all three - price has never really got into gear the way the previous price moves did with price in a range between $60 and $90 for the last 18 months with only one visit over $90. I hesitate to forecast where next.

Sold

Assignments on sold puts created margin problems which the broker took action to fix. What gets me is what they choose to sell - lots less than 100 shares which are subject to covered calls for example.

Credit Agricole (ACA.PA): French Bank. Sold by broker for 9.5% profit since August 2022. This partial sale created an uncovered call holding of less than 100 shares - had to buy back one contract as the call was in-the-money which wiped out the profit.

Banco Santander (SAN.MC): Europe Bank. Sold by broker to cover margin problem created by early assignements for 18.3% profit since November 2022.

JSC National Atomic Company Kazatomprom (KAP.IL): Uranium. Sold by broker for 12.3% blended profit since July/September 2022.

I did some of my own tidying up to manage the risk of any other early exercises on sold puts.

WPP plc (WPP.L): Advertising. Ran out of patience on a parcel too small to write covered calls. 11.8% blended loss since July 2018/September 2022 - averaging down in September was a profitable add. More patience could be rewarded but recession likelihood makes this potentially a long wait.

EuroStoxx 50 (ESTX50): Europe Index. Closed out December 2024 4300 strike call option for 33.7% blended profit since August 2021/August 2022. Averaging down ramped up profit nicely. With so much time still to run I figured there would be time enough to get back to this trade. This holding follows a series of rollups going back all the way to November 2017

Quick look at the chart shows entry for the averaging down trade - call option is not yet in-the-money. Too bad as the trade was on the right trajectory

Following stocks were assigned on covered calls

ABB Ltd (ABBN.SW): Europe Industrials. 0.5% blended profit since November/December 2022

Aegon NV (AGN.AS): Dutch/US Insurance. 5% blended profit since June 2016/August 2022/October 2022 - stock has also been added to with DRP's along the way.

Commerzbank AG (CBK.DE): German Bank. 11.8% blended profit since September/November/December 2022

Deutsche Bank AG (CBK.DE): German Bank. 4.5% blended profit since November 2022. European bans are at last starting to move

Telecom Italia (TIT.MI): Italy Telecom. The crows came to roost with a 73% blended loss since March/May 2018.

Barclays plc (BARC.L): UK Bank. 2.5% blended loss since March/June/September 2022. Capital trades on Barclays have been a bit hit and miss over the last 12 months (4 losses) with income trades leaving an overall profitable outcome

Centrica plc (CNA.L): UK Utility. 2.15% profit since November 2022.

American Airlines Group Inc (AAL): US Airline. 48% loss since January 2020 - thanks Covid-19

Delta Air Lines, Inc (DAL): US Airline. 15.5% loss since September 2021 - Covid-19 recovery did not quite pan out.

Alerian MLP ETF (AMLP): US Oil. Lost trading costs only since September 2022. I will replace this rather than trade XLE (below)

Amazon.com (AMZN): US Retail. 2.8% profit since November 2022. AAPlus idea.

Baker Hughes Company (BKR): Oil Services. 19.5% profit since July 2022.

Coeur Mining, Inc (CDE): Silver Mining. 7.2% blended loss since March/April/August 2022. This is ugly as there are entries higher than this from earlier - the price of hedging with silver.

Hecla Mining Company (HL): Silver Mining. Two strikes with 14.3% blended loss since July 2021/May/June 2022 and 9.4% profit since November 2022 = an overall loss on hedging using silver.

Eneti was Scorpio Bulkers Inc (NETI): Bulk Shipping. 29% blended loss since May 2017/May/November 2020/August/September 2022. Averaging down helped. The chart update shows price has now moved out of the consolidation zone - time to buy back and rebuild. I had added Star Bulk Carriers (SBLK) earlier in the week.

Posco (PKX): Korean Steel. 9.9% profit since December 2022. Posco owns large lithium tenements in South America which is what I am interested in - pricing does not fully reflect that - comparative chart with US Steel (X - bars) and Albemarle (ALB light blue line) shows the market is catching on.

Transocean (RIG): Oil Drilling. 3.8% profit since December 2022 - price did recover the poor spread I got at trade time (see TIB633)

Visa Inc (V): Payment Services. 10.3% profit since September 2022. AAPLus like Mastercard (MA). I shifted to Visa as it is lagging somewhat which paid off tidily.

Warner Bros Discovery (WBD): US Media. 52.3% blended loss since April 2022 - the AT&T (T) spin-off from hell.

Energy Select Sector SPDR Fund (XLE): US Oil. 3.9% loss since November 2022. Income trades recovered 74% of the cpaital loss. Initial trade idea was an AAPlus idea. Chart shows why I prefer Alerian MLP (AMLP).

ASX Portfolio

Still working on approaches for this portfolio. I noticed that limit sell orders are valid for one month only. New sell orders put in place for 30% profit or 52 week high broadly speaking - with a few tweaks.

Added in another $2000 (this will be my monthly commitment while I work out how to invest my house sale proceeds). Am refining the way I choose stocks and added in some topping up. I will still run the stock screens. Any stocks that appear on there are candidates if they are more than 30% from 52 week high. If a stock is new to the list I will invest $200. If a stock is already on the list I will top up once another $100 (making $300)

Top ups

Boral Limited (BLD.AX): Building Materials. Topped up to $200.

Aussie Broadband Limited (ABB.AX): Telecom

Kogan.com Ltd (KGN.AX): Retail

Reece Limited (REH.AX): Building Materials

Bell Financial Group Limited (BFG.AX): Investment Management.

New buys

Humm Group Limited (HUM.AX) (4.27%): Payment Services

GUD Holdings Limited (GUD.AX) 5.38%: Building Materials

Resimac Group Limited (RMC.AX) 6.96%: Financial Services

Ramsay Health Care Limited (RHC.AX) 1.45%: Healthcare

Westgold Resources Ltd (WGX.AX): Gold Mining

Dicker Data Ltd (DDR.AX): IT Services.

Sold

Sandfire Resources Ltd (SFR.AX): Copper Mining. 35% profit since November 2022

Expiring Options

iShares MSCI India ETF (INDA): India Index. With price closing at $42.68, remaining 45/55 bull call spread expired out-the-money. Trade idea was looking for a recovery in India economy one year after the start of the Covid pandemic. Trade structure was a 45/55 call spread partly funded by shorter expiry sold put and later a few credit spreads.

The chart shows some of the funding moves after the initial trade set up. Price has been stubbornly sitting in a range below the bought call (45) since its last breakthrough in March 2022. It is that stubborness that had me buying back sold puts as I did not want to be long the stock but was hoping for the call spread to win - did not happen. See [TIB523](TIB 523)

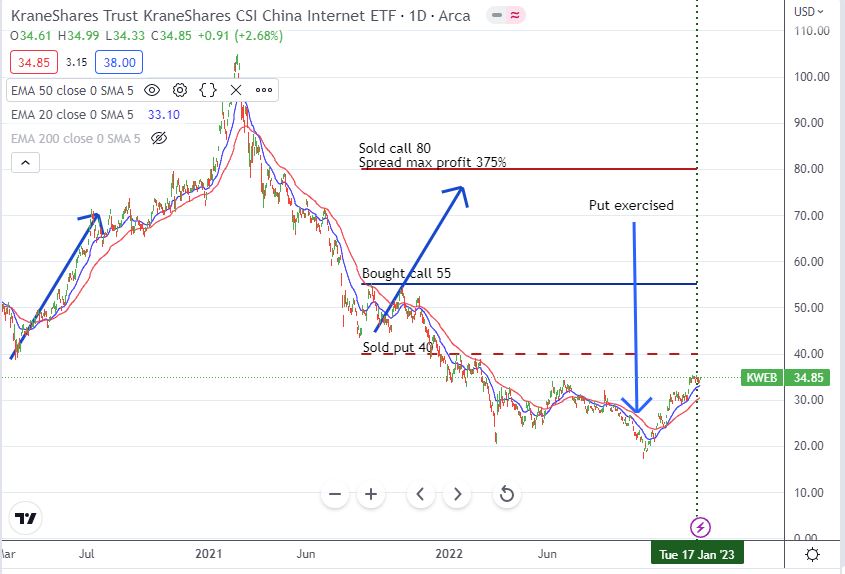

KraneShares CSI China Internet ETF (KWEB): China Internet. With price closing at $34.85, 52.42/77.42 call spread expired out-the-money. The initial trade set up was fully funded by a sold put (37.42) - that was exercised early in October 2022 and sold on a covered call assignment a month later. See TIB556

Quick look at the chart shows the update - the trade rationale was that the technology regulation changes being proposed by the China would work through - well the changes were more of a crackdown than anything else and price has drifted lower and stayed lower.

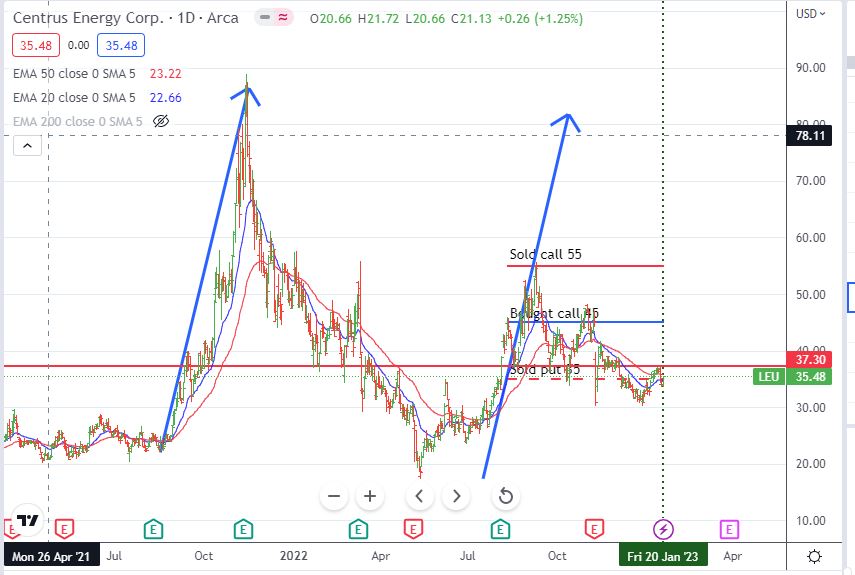

Centrus Energy Corp (LEU): Uranium. With price closing at $35.48, 45/55/35 call spread risk reversal expired out-the-money - just. The net profit was 38% of the call spread net premium. Trade rationale was to follow some strong price moves with a longer dated call spread. See TIB618

Quick look at the chart shows momentum did flow on from trade entry but then stalled in October 2022, about the time the Inflation Reduction Act was finalised. I am going to guess that uranium fell out of one of the deal details. My reearch today indicates that the nuclear credits favour producers of High-Assay Low Enrichment Uranium (HALEU) - Centrus only has a pilot plant in Piketon, Ohio but will be scaling up production modularly.

VanEck Gold Miners ETF (GDX): Gold Mining. With price closing at $32.42, 38/44 call spread expired worthless. This call spread was funded fully by a shorter duration sold put (33) and I wrote a few more after that all of which worked the right way.

For some reason, I did not write up the initial trade rationale other than to say it was a hedging trade. A quick look at the chart would suggest that the trade entry time was not picked for technical reasons as it is not really on any form of reversal. All I can say is the logic of using shorter dated sold puts did pay out well as price has spent more time below that sold put level (33) than it has above. This is just fine as hedging trades structured as cash neutral trades is the design idea.

AT&T Inc (T): US Telecom. With price closing at $19.23, 35/40 call spread expired worthless. I had bought back the sold put (28) sometime earlier to avoid buying more of the stock which took the trade away from cash neutral. These options were redefined with the spin off of Warner Bros - I never did follow up at the time what the details were - should have closed them out for some recovery of premium then.

I have gone through these LEAPs examples to draw the lessons. Trade management would have found profitable exits along the way. As the trades were mostly cash neutral, the key risk factor to manage is the risk of being exercised early on the sold put. If that level is acceptable fundamentally, go to exercise and live with the trade as an investment. In my OptionsAnimal training, they like to use Bull Call spreads only when they are super confident of the trade preferring to use credit spreads. The India case shows this would have worked better as I did both and the capital loss came from the call spread, not the credit spreads. Last lesson is LEAPs do not do well when markets hit major discontinuity - like Covid, or the Ukraine war or Raging Inflation. They need more time - then roll them out sooner.

Hedging Trades

Vanguard European Stock Index Fund (VGK): Europe Index. With price closing at $60.46, 55/53 ratio put spread expired worthless for a small profit.

Cryptocurrency

Sandbox (SANDBTC): Price broke downtrend and looks be making a higher high. Was happy to make the trade as my last entry was only a little higher and that run was massive

Set up a savings opportunity for a tidy 14.5% APR - this does preclude me from selling for 90 days.

Income Trades

In pension portfolio 53 covered calls reached expiry with 22 assignments - shown in brackets (UK 3 (2), Europe 10 (6), US 53 (14))

Naked Puts

Dutch Bros Inc (BROS): US Restaurants. Last week I sold a February expiry naked put at same strike as covered calls I am holding as price had moved above the strike (35). Added two more contracts at an even bigger 8.14% premium. As it happens price closed below the 35 strike and covered calls were not assigned.

Deutsche Bank AG (DBK.DE): German Bank. With price closing at €11.98, the 10.8 strike sold put I have been kicking down the road for months now finally expired. I have been writing naked puts since January 2020 with the Ukraine War starting in January 2022 upsetting the flow of profits. Kicking the can down the road has clawed back most of the losses now down to 2.8%. The trade management lesson is if I had gone to exercise this last cycle I would be 8% ahead.

Credit Spreads

Engie SA (ENGI.PA): French Utility. With price opening at €12.85 and trading lower the 14/13.6 credit spread has traded through the bottom (TTB). Thought crossed my mind that there was enough value in selling the bought put and going to assignment on the sold put. Did I get that right? Received net profit of €0.74 plus the €0.29 from the sold put = €1.03 gives breakeven of €12.97 which is a 0.93% premium to the opening price (Jan 17). Price did close lower. Better to let the credit spread die TTB and just buy the stock. Covered calls will recover the premium in one month - not too bad.

Got the trifecta on credit spreads with one spread going TTB for a loss of 2.8%% - not accounting for the premium.

AMN Healthcare Services (AMN): US Healthcare. Price dropped hard from the $105.03 open (Jan 18) on the back of nurse staffing shortage reports. This has put the 105/95 credit spread under pressure - on Jan 18 it was safe and then dived into risk of exercise. As I am already facing margin pressure, I cannot afford an early exercise here too. I reduced the exposure by closing out one credit spread leaving one open for 40% of the total risk on the trade and wiping out all the net premium received. AAPlus have added to their position on this weakness.

With quite a few European stocks (banks and insurance) likely to get assigned on covered calls for profits, set up February expiry credit spreads around the strikes stock will be assigned at in my other portfolio

Deutsche Bank AG (DBK.DE) ROI 303% Coverage 1.6% and ROI 27% Coverage 1.6% (two portfolios)

Commerzbank AG (CBK.DE) ROI 30% Coverage 3.5%

Crédit Agricole S.A. (ACA.PA) ROI 22% Coverage 2.3%

AXA SA (CS.PA) ROI 16% Coverage 1.4%

Currency Trades

Australian Dollars Big casualty of the margin calls is broker closed out Australian Dollar holding which I had set aside to cover the next two months pension payouts.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

January 16-20, 2023

Posted Using LeoFinance Beta

Edit: Report date 2023 not 2022