TIB - An Investors Journal #637 - US Automotive, US Retail, US Pharmaceuticals, Gold Mining, China Technology, Rare Earths, US Telecom, US Treasuries + more

A big move in the second week of the fortnight. Not much trade activity through my holidays but good to lock in some solid profits on options exercised - prices need to stay where they are or better

Portfolio News

In a fortnight where S&P 500 rose 4.20% and Europe rose 8.73%, my pension portfolio rose in the middle at 6.20%. Part of the discrepancy is my portfolio does get dragged down by covered calls that go in-the-money - the plus on the stock side gets set off by the minus on the sold call side.

Big movers of the fortnight were QuantumScape Corporation (QS) (+46.4%), JinkoSolar Holding (JKS) (+44.1%), Warner Bros. Discovery (WBD) (+38.6%), Stuhini Exploration (STU.V) (+37.1%), Stroud Resources (SDR.V) (+35.7%), American Airlines Group (AAL) (+33.8%), ChargePoint Holdings (CHPT) (+24.7%), Transocean (RIG) (+24.1%), 3D Systems Corporation (DDD) (+23.5%), Dutch Bros (BROS) (+23.1%), GoGold Resources (GGD.TO) (+23%), Latin Resources (LRS.AX) (+22.4%), Northern Dynasty Minerals (NAK) (+22.3%), Air France-KLM (AF.PA) (+22.1%), Wynn Resorts (WYNN) (+21.6%), Silver Lake Resources (SLR.AX) (+21.5%), First Solar (FSLR) (+20.3%), De Grey Mining (DEG.AX) (+19.1%), Livent Corporation (LTHM) (+19.8%), 29Metals (29M.AX) (+18.8%), Lifeist Wellness (LFST.V) (+18.2%), Tilray Brands (TLRY) (+17.8%), Airbnb (ABNB) (+17.4%), Delta Air Lines (DAL) (+16.2%), Ramelius Resources (RMS.AX) (+16.7%), American Rare Earths (ARR.AX) (+15.8%), Telecom Italia (TIT.MI) (+15.4%), Global X MSCI Nigeria ETF (NGE) (+15.2%), Kogan.com Ltd (KGN.AX) (+15.1%), South32 Limited (S32.AX) (+15%), Robinhood Markets (HOOD) (+14.5%), Bayhorse Silver (BHS.V) (+14.3%), Barrick Gold Corporation (GOLD) (+14.3%), The Walt Disney Company (DIS) (+14.4%), Nickel Industries (NIC.AX) (+14.4%), Fiverr International (FVRR) (+14.1%), Sandfire Resources (SFR.AX) (+14%), Barclays PLC (BARC.L) (+14%), VanEck Gold Miners ETF (GDX) (+13.9%), Enel SpA (ENEL.MI) (+13.9%), iShares STOXX Europe 600 Technology UCITS ETF (EXV3.DE) (+13.6%), Amazon.com (AMZN) (+13.2%), Global X Social Media ETF (SOCL) (+13.2%), Boral (BLD.AX) (+13.1%), Coeur Mining (CDE) (+13.1%), L&G Hydrogen Economy UCITS ETF (HTWO.SW) (+13.1%), Credit Suisse Group (CSGN.SW) (+13.1%), Applied Materials (AMAT) (+12.9%), Arafura Rare Earths (ARU.AX) (+12.9%), POSCO Holdings (PKX) (+12.8%), iShares MSCI China Small-Cap ETF (ECNS) (+12.8%), WPP plc (WPP.L) (+12.6%), ABN AMRO Bank (ABN.AS) (+12.2%), Hecla Mining (HL) (+12%), Banco Santander (SAN.MC) (+11.9%), PayPal Holdings (PYPL) (+11.6%), Paladin Energy (PDN.AX) (+11.4%), Fortescue Metals Group (FMG.AX) (+11.2%), Canopy Growth Corporation (WEED.TO) (+11.1%), Navios Maritime Holdings (NM) (+10.9%), Allkem (AKE.AX) (+10.9%), Nippon Steel Corporation (5401.T) (+10.8%), American Eagle Outfitters (AEO) (+10.4%), Deutsche Bank AG (DBK.DE) (+10.4%), Citigroup (C) (+10.4%), ABB Ltd (ABBN.SW) (+10.3%), Global X Uranium ETF (URA) (+10.3%), Global X Autonomous & Electric Vehicles ETF (DRIV (+10.2%), Stem, Inc. (STEM) (+10.2%), Mizuho Financial Group (8411.T) (+10.1%), Intesa Sanpaolo (ISP.MI) (+10.1%)

The length of the list shows a broadly based move upwards. There are some key themes showing: Alternate Energy, Infastructure Spending, Base Metal Commodities, Interest Rates, Gold and Silver Mining. A smaller theme is the emergence of some consumer stocks in retail, in restaurants and in airlines. Not often are there two stocks from Japan.

US markets celebrated lower inflation numbers in a slightly delayed Santa Claus Rally

Inflation is the key though I have to say 6.5% is still pretty scary when the Federal Reserve is targeting 2 to 3%.

I did not follow the news while I was on holiday but the numbers did tell me there was a deal made on Infrastructure spending - it is behind the alternate energy and commodity metal moves.

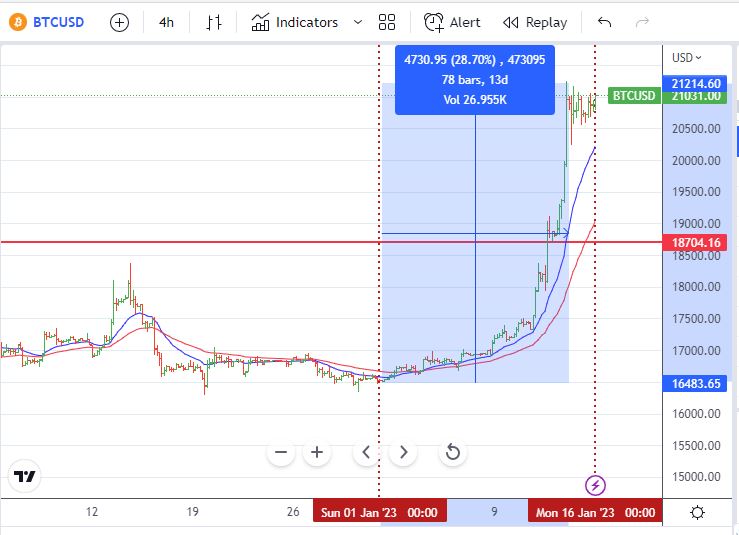

Crypto booms

The fear went out of the crypto markets with Bitcoin price pushing 28% trough to peak and trading comfortably over $20k for the first time since November 2022.

Ethereum went a little better with a move trough to peak of 34%

The moves were also in the altcoins - example Polkadot up 55%

My most important holding is in HIVE - also up 55%.

You know the fear is out the markets when Solana goes up 208%

Bought

Tesla, Inc (TSLA): US Automotive. Tesla announced record sales for 2022 - I took that as a buying signal. Analysts hated the report as they were expecting a higher number. Also added in a January expiry credit spread offering 36.5% ROI with 0.1% price coverage (now 13.3%). I figured the market over-reacted to the numbers.

Amazon.com (AMZN): US Retail. Rounded up holding to be able to write covered calls in one portfolio

Bristol-Myers Squibb (BMY): US Pharmaceuticals. Received a dividend advisory suggesting that it would be beneficial to exercise long call to grab the dividend. I am holding a 62.5/70/52.5 call spread risk reversal. With price opening at $72.25 (Jan 4) there was a chance I would be exercised on the sold call (70) and there is little chance of the sold put (52.5) being touched by Jan 20 expiry.

- Exercised the bought call to grab the dividend $0.57 dividend.

- Bought back the sold call for a small 2.35% profit.

- Leaving the sold put (52.5) to run to expiry as a naked put

- Sold a March expiry put at 67.5 strike with 7% price coverage

- Wrote March expiry covered call for 2.57% premium with 11% price coverage.

If all goes to plan (i.e., price stays above $52.50), breakeven for the trade will be $64.92 = 11.3% discount to that $72.25 opening price (not including the March sold put)

Trade rationale set out in TIB579 said the trade needed more than the 2018 run to win. Well it got that - the blue arrow on the chart.

Yamana Gold Inc (AUY): Gold Mining. Am holding a January expiry 4.4/5.5/3.5 call spread risk reversal. With price opening at $5.83 this is well in-the-money. I did the same thing - exercise the long call (4.5), buy back the long call (5.5) and leave the sold put (3.5) to run to expiry. If price stays above the sold put level (3.5), breakeven is $4.67.

Why did I do this? I am keen to add to my gold hedging position and Yamana has dumped the takeover offer from Gold Fields in favour of one from Pan American Silver (PAAS) and Agnico (AEM). I did the calcs after the fact - current value of the offer is $6.15 v $6.11 close (Jan 13) which shows my instincts were right. Also wrote April expiry covered call for 7.9% premium with 28.5% price coverage. Sold strike (6) is below that current valuation by $0.15 - the seller had not done the calcs either as I received $0.37. Shareholder meeting is January 31 after which the stock will almost certainly be exercised early.

The rationale in TIB584 for the initial trade set up was to increase gold hedging in one portfolio. The chart shows the value of a long-dated set up with price having three goes to trade through the top of the spread. It also shows the sold put (3.5) used to fund the trade was set at the right place

Invesco China Technology ETF (CQQQ): China Technology. Noted two key China headlines - relaxation of Covid-19 travel restrictions and softening on technology regulation crackdown. Bought a small parcel of stock maybe a little ahead of the curve (Jan 5). Wrote January expiry covered call for 1.55% premium with 3.9% price coverage = keeping it tight and close

Elevance Health Inc (ELV): US Healthcare. AAPlus idea to add to holding after price has been hammered and shown signs of bottoming. I have been using credit spreads and losing - time to take a small stock nibble (not enough to write covered calls). Also added in a new credit spread offering 42.9% ROI with 2.2% price coverage. I have one open that is TTB - I might bite the bullet and let it go to assignment.

The chart is a mess with price trading in a 15% range since the April 2022 high. It is hard to pick any patterns to trade other than there is support around the 460 level which is where the last credit spread was placed

Northern Minerals Limited (NTU.AX): Australian Rare Earths. Took up share purchase plan opportunity. Trading 15% higher now.

Cobalt Blue Holdings (COB.AX): Australian Cobalt. Took up share purchase plan opportunity. Trading 9.4% higher now.

Latin Resources (LRS.AX): Copper/Lithium Mining. Exercised options at 900% profit from exercise price - it pays to hold on though this exercise price was double the share purchase plan run in January 2020.

Sold

GE HealthCare Technologies (GEHC): US Healthcare. Sold partial shares after spin off from General Electric (GE) for a small profit on adjusted cost base.

Verizon Communications Inc (VZ): US Telecom. Assigned on a covered call for 16% blended loss since July 2022. This was an AAPlus idea that simply under-performed. This week they have added to their holdings as they feel comfortable with the dividend yield (6.24%). I was not paying attention as I missed the $2.61 dividend with record date 3 days later. Income trades have only recoverd 10% of the capital loss

Replaced part of the holding the following week at 2.9% premium to assigned price. Wrote February expiry covered call for 1.56% premium with 4.4% price coverage. Also set up a credit spread with sold strike at the level stock was assigned (40) offering 28.2% ROI with 3% price coverage.

Hedging Trades

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price trading around $105.68 (Jan 11), sold the bought leg of 107/104 ratio put spread for a small loss. Felt confident that price would not drop enough to get assigned on the sold leg. I had protected the ratio put spread by adding in a bought put below the spread (100) - those two legs expired worthless leaving a net profit on the trade of 36%. Always happy to get paid for hedging trades.

Put in place a February expiry 105/102 cash neutral ratio put spread. This offers protection for a price drop between 0.64% and 3.6% for 4 weeks.

Quick look at the chart shows price did exactly what the trade was protecting - drop at entry (left hand end of left had rays) below the sold put (104) at wich time the protection was put in below (100). The new trade is set below current price (right hand rays)

Cryptocurrency

No trades

Income Trades

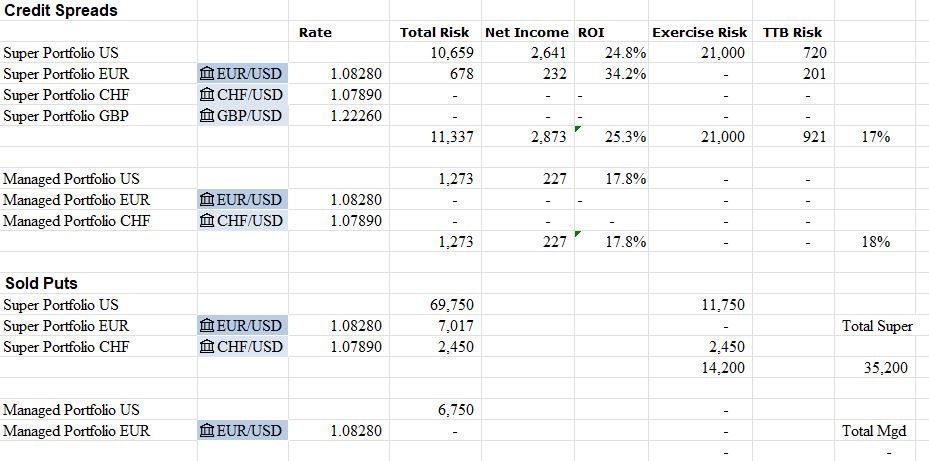

Wrote 11 covered calls over the period across the portfolios (Europe 1 US 10), 3 credit spreads (all US) and one naked put (also US)

Spread exposure is well within margin limits especially with a large swathe of assignment expected on covered calls. Pension portfolio has one credit spread at risk of exercise (AMN) and two TTB (ELV and ENGI.PA)). Naked put exposure is all February expiry and beyond

Naked Puts

Dutch Bros Inc (BROS): US Restaurants. Price moved above sold strike (35) on covered calls (Jan 11). Sold a same strike (35) naked put for 6.8% premium with 2.9% price coverage for a part of the portfolio. Will be watching price closely in the week to expiry - I doubt price will drop 6.8% in the week.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

January 2-13, 2023

Posted Using LeoFinance Beta

Edit: Added in Spreads image

Edit: Report date 2023 not 2022