TIB - An Investors Journal #635 - Europe Oil, Speciality Chemicals, Medical Cannabis, Gold Mining, ASX Stocks (Cheese), Dutch/US Insurance, German Airline, Silver, Dutch Bank, Gaming

Options expiry was quiet as markets pulled down away from covered call strikes - a quiet week other than some stock picking in Japan and a few averaging down trades. Cheese for Australia.

Portfolio News

In a week where S&P 500 dropped 2.55% and Europe dropped 2.73%, my pension portfolio dropped 1.91%.

Big movers of the week were GoGold Resources (GGD.TO) (+28.6%), Arafura Rare Earths (ARU.AX) (+19.8%), Redbubble Limited (RBL.AX) (+17.3%), Mamiya-OP Co (7991.T) (+16%), Transocean (RIG) (+14.7%), Teekay Corporation (TK) (+11.8%), Kelsian Group (KLS.AX) (+11.1%). It is hard to discerne any themese from this list of movers and there is only strong drilling results to explain GoGold jump. Of note is Mamiya has been on this list quite a few times in recent months.

https://finance.yahoo.com/news/gogold-announces-strong-drilling-results-113000604.html

The market is beginning to price in a recession not helped by Fedspeak which is leaning to keeping up the rate hikes for a while yet. Their mandate is to control inflation and they are adamant to revert to that and no longer keeping an eye on employment.

Crypto Bumbles

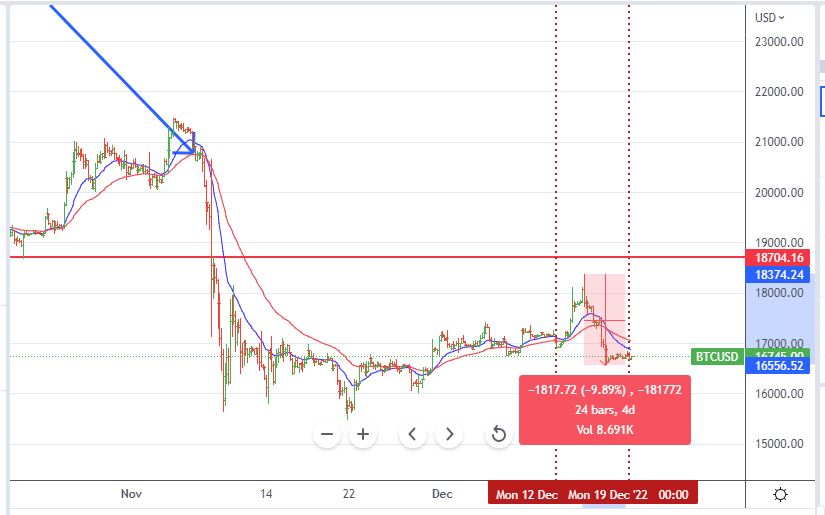

Bitcoin price tried to break out of the week's consolidation and then was smacked down on the USDC/CRO news dropping 1.5% on the week with a fall of 9.89% from the peak. That range is a little wider than the last two weeks but not scarily wide.

Ethereum chart looks similar with a peak to trough range of 14.46% which is less that prior weeks and not double the Bitcoin range we have been getting used to

One coin only moved up in my portfolios - RUNE up 15% on the week. Happy with that as I topped up last week

Bought

Barryroe Offshore Energy (BEY.L): Europe Oil. Averaged down a long held stock - time to get a little movement and exit

Tokai Carbon Co (5301.T): Japan Speciality Chemicals. Ran the stock picking screens and hit this on both screens - chart shows a classic breakout. There are parts of the business in graphite that could be key for batteries for electric vehicles. Dividend yield 2.70%.

Mipox Corporation (5381.T): Japan Speciality Chemicals. Business is all about abrasives used for polisihing stuff including semiconductors. Dividend yield 3.12%

BOD Australia (BOD.AX): Medicinal Cannabis. BOD has been in top movers list twice in the last few weeks - added to my holding in one portfolio

De Grey Mining Limited (DEG.AX): Gold Mining. Receieved update on share purchase plan allocation doen in November - got to keep with the SPP's. This one was run at 5% discount to price on closing day (Nov 4) - now 20% higher than that day close.

Aegon NV (AGN.AS): Dutch/US Insurance. Assigned on sold put at 0.85% premium to 4.56 closing price. Price had been holding above the 4.6 strike all week until late trade (Dec 16). This sold put was added in last month to complete funding of a December expiry 5.5/7 call spread - that spread expired worthless but was fully funded.

Sold

Deutsche Lufthansa AG (LHA.DE): German Airline. Assigned on covered call for 7.6% profit since November 2022. I did have hedging trades open on Lufthansa which did not cover the bought premium. The capital profit and covered call income covered the losses on hedging - I had been using this counter to test hedging ideas from OptionsAnimal.

iShares Silver Trust (SLV): Silver. Assigned on covered call for 6.1% blended loss since January/June/November 2021/July 2022. The way markets are moving it looks like the hedging value for silver is about now and not 18 months ago.

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Assigned on covered call for 13.3% profit since September 2022.

Wynn Resorts, Limited (WYNN): Gaming. Assigned on covered call for 11.6% loss since August 2021. An opening trade that got caught out by renewed lockdowns in China.

ASX Portfolio

Bega Cheese Limited (BGA.AX): Packaged Food. Ran the screens at the start of the week and added the leading cheese producer. Dividend yield 2.94%. Chart shows a classic double bottom and a good 40+ percent to the 52 week high.

Expiring Options

My investing coach was very keen on long dated options trades. I had a few come to expiry some dating back to 2018. The lessons are maybe to cut and exit at a fixed premium point (say 50% down) and certainly when there are major changes in market situations. Examples since 2018 are negative interest rates in Europe, a war in Ukraine, a pandemic like Covid-19 (though markets have come through that) and raging inflation. I have not done that and racked up some losses in Europe

Credit Suisse Group AG (CSGN.SW): Swiss Bank. I reported last week on the adjustment of the sold put which was part of the 11/14/8 call spread risk reversal. The call spread expired worthless.

Commerzbank AG (CBK.DE): German Bank. Call option going back to 2018. I was working on a staircase of options - this was the top of the staircase. The staircase was working well at strikes 8 and 10 and stuttered at 12 and failed at 16. That said. call spread trades since May 2016 have been profitable in a time when investing in Commerzbank was hard work. What I wrote at the time in TIB163

Stepping bank, what is this trade all about?

Short term interest rates are rising in Europe. It is only a question of time before the European Central Bank raises rates. I am figuring there will more rate rises than the markets are pricing in and they will happen sooner. Rising interest rates are good for bank profits. I have shared the European interest rate chart before in TIB134 4 months ago - I have extended the parallel channel which price has been in since the beginning of 2017. I know that when price breaks out the channel it will break with force. A repeat of the drop we saw from the September 2016 highs starting anytime soon will take price down to the 2015 lows inside a single quarter. With 2021 and 2022 expiries, I have time on my side.

Deutsche Bank AG (DBK.DE): German Bank. Long dated call option bought in February 2018 - these were the words in [TIB187](

A 15% premium with 58 months to go feels like a good premium. News flow around Deutsche Bank has not been great. I have to believe that senior management will fix things internally by then and European interest rates will almost certainly be quite a bit higher then. German 10 year Bund yield touched 0.9% on Monday

TIB187). Well the management team never did pull it off and European interest rates only just went positive in late 2022 - hard to predict that 58 months ago.

ING Groep N.V. (INGA.AS): Dutch Bank. Call spread going back to February 2022 just before the Ukraine War. Timing could not have been worse and averaging down directly after the war started would have helped to migitate the loss if I had chosen to exit when price started to recover.

Shell plc (SHELL.AS): Europe Oil. Call option rolled up from strike 24 in May 2018. I was always keen to be out-the-money to grab delta profits.

Chart shows this was one roll up too many with price never getting back to the 30 strike once it dropped from the 2019 highs. The combined trades were profitable even though the final trade lost.

Casino, Guichard-Perrachon S.A. (CO.PA): French Supermarket. Words in TIB539

Casino is lagging - so I took a punt on European recovery dragging it back up. I bought the stock and a December 2022 28/36 bull call spread. With net premium of €2.05 this offers maximum profit potential of 290% for a price move of 35%.

Those were the words - well the chart shows there was no break to the upside - price just kept drilling lower for 18 months to expiry. The stock trade made at the time also lost with two thirds clawed back with covered calls.

Cryptocurrency

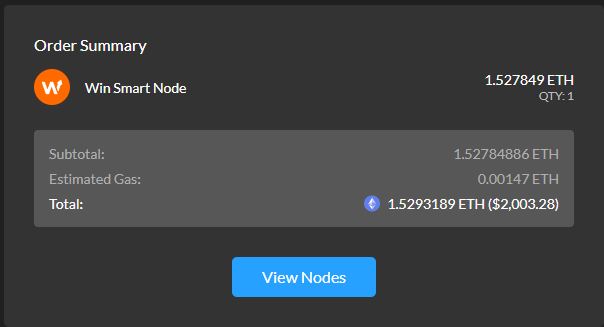

Connect United Bought a WIN Node to get back to some form of crypto mining.

Income Trades

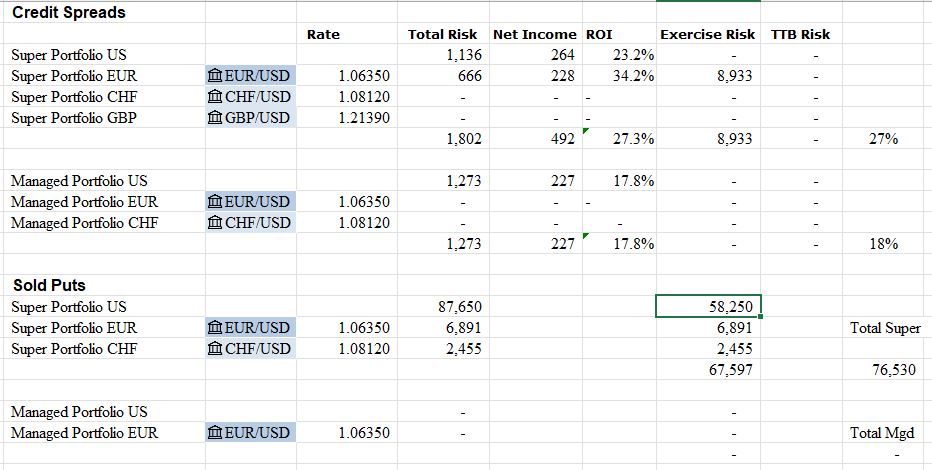

In all portfolios, 87 covered calls went to expiry with only 3 assigned (UK 3 Europe 19 US 63 Canada 2). Only two naked puts went to expiry (both US on Nokia).

Naked Puts

Credit Suisse Group AG (CSGN.SW): Swiss Bank. Tried to kick the can down the road on the 7.57 strike put options. I did succeed in a transaction to sell June expiry at the same strike in a nearly cash neutral trade. Complication is the contracts are not identical - so I had 3 short and 3 long December contracts. As they are at the same strike, they should settle at expiry. The problem is there is a chance of early exercise and then I have margin problems. I did the fix trades - sold one at the same price as I bought and bought back the others at a slightly higher price - a trading error of about $30 - mostly trading costs. All I can hope for now is Credit Suisse management to get their restructuring working right and price to go up a bit and then I can exit the sold puts - got 7 months for them to do that.

Credit Spreads

Cboe Global Markets (CBOE): Financial Markets. New spread with December expiry for 9.9% ROI with 4.7% price coverage - not bad for 5 days work.

Of the 9 spreads expiring in December, 3 were trading in-the-money coming up to expiry and required adjustment as I was not comfortable going to assignment. None went TTB.

Kicked the can down the road on a few credit spreads - buying back the sold put and selling another later

- AMN Healthcare Services, Inc. (AMN): Aged Healthcare. Left open a naked put.

- QuantumScape Corporation (QS): Battery Technology. Set up a new spread at a lower strike - partial only (completed on Monday after weekend).

- Energy Select Sector SPDR Fund (XLE): US Oil. Set up a new spread at a lower strike

Exercise risk is currently a bit high in pension portfolio driven by the ratio put spreads on TLT - I expect that to settle down once the nerves go out of the market. I will look to add in protection lower down for TLT and AMN.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

December 12-16, 2022

Posted Using LeoFinance Beta

Congratulations @carrinm! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2000 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts:

Support the HiveBuzz project. Vote for our proposal!