TIB - An Investors Journal #634 - Europe Banks, French Utility, Europe Industrials, Korean Steel, Silver Mining, ASX Stocks (Healthcare), US Treasuries, Europe Index, Ethereum, Altcoins (RUNE, EOS)

A tricky week in markets with S&P 500 making longest losing streak since September - not a big deal in my books but the media likes that sort of hyped wording. Was a week for using down days to keep nibbling away at buying stock back - nibbling it was.

Portfolio News

In a week where S&P 500 dropped 3.35% and Europe dropped 1.51%, my pension portfolio dropped 3.05% - not quite as bad as S%&P500. The drags were Australian resources like Cobalt Blue (COB.AX) down 14%, Canadian marijuana like Canopy Growth (WEED.TO) down 32%, a select few US stocks like Dutch Bros (BROS) down 12.8% and shipping stocks. Only parts in the black were Japan and Switzerland with a bounce in Credit Suisse (CSGN.SW)

Big movers of the week were AdAlta (1AD.AX) (+24.4%), Panther Metals (PNT.AX) (+20.6%), Starr Peak Mining (STE.V) 9+20%), Beamtree Holdings (BMT.AX) (+13.3%), ProShares UltraPro Short QQQ (SQQQ) (+11.2%). No themes there other than there is life in parts of the Australian market - two of the 3 in the list are medical related.

US markets went back to nervy - often happens at the end of earning season when the only data coming out is economic data and Fed speak. Fed speak was a bit mixed - fewer small hikes to not finished yet.

The fear of recession is building with layoffs announced across sectors from banking (Morgan Stanley (MS) and Goldman Sachs (GS)) to the likes of Pepsico (PEP). Hard to tell from the headlines what is coming - I am guessing a swamp recession is shallow - not deep water.

Crypto Bumbles Along

Bitcoin price could not hold the momentum of the back half of last week and dropped but only a 3.8% peak to trough finishing the week 1.9% lower = a quiet week.

Ethereum chart looks similar with range twice the size with peak to trough of 6.6%

Not a lot moving up - biggest move amongst my coins was EOS up 15% after a bottoming out process (vs ETH)

Bought

Stuhini Exploration (STU.V): Silver Mining. Averaged down and doubled position size as stock made it to top movers list last week.

ENGIE SA (ENGI.PA): French Utility. Increased holding as it seems likely that my holding in Electricité de France S.A. (EDF.PA) will go to assignment or be acquired by the French Government at the same price. Dividend yield 5.88%. Also added a January expiry 14/13.6 credit spread offering 29% ROI with 3.1% price coverage.

Commerzbank AG (CBK.DE): German Bank. Slowly rebuilding my holding on down days.

Centrica plc (CNA.L): UK Utility. Used down days to add to my buy back holding (two tranches). Wrote January expiry covered call for 1.34% premium with 7.8% price coverage. Dividend yield 2.10%

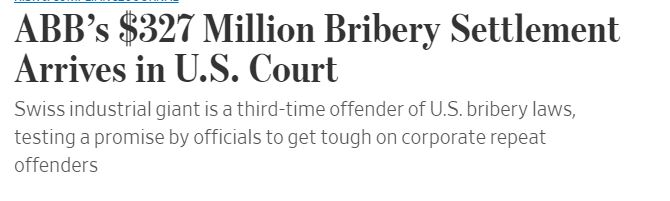

ABB Ltd (ABBN.SW): Europe Industrials. Used a down day to complete replacement of stock assigned last month at 1% premium to assigned price. Will make that up in the first covered call - did just at 1.3% premium with 4.2% price coverage. ABB is an important plyer in electric charging equipment - hence staying invested. Dividend yield 2.81%

Too bad I only read about this after the trade.

Posco Holding (PKX): Korean Steel. Used a down day to replace stock assigned last month at 9% premium to assigned price. Strong US dollar has held back profits - that should change as dollar softens. My interest in Posco is not in steel but in its diversification into electric vehicle components and materials. Wrote January expiry covered call for 1.55% premium with 9.89% price coverage.

Credit Suisse Group AG (CSGN.SW): Swiss bank. Assigned a week early on a strike 7.57 strike sold put. This was the sold put leg of an 11/14/8 call spread risk reversal taken out in March 2021.

The updated chart shows price tracking sideways from trade entry (the start of the rays) and then falling over at the start of 2022. The expectations as the world recovered from the covid collapse and as rates began to rise is the pink arrow. I have overlaid the chart of UBS Group (UBSG.SW - blue line) which did follow that scenario.

As the trade was a cash neutral call spread risk reversal, I was happy to hold the call spread to expiry. What I should really have been looking to do was protect the sold put from the downside. What is left now? Hope that the Swiss National Bank and the markets feel Credit Suisse is too big too fail and keep holding for the very long term. Now the capital raising is over I will look to kick the can down the road on the other 3 contracts not yet assigned.

ASX Portfolio

Ran the price screens during the week and did a bit more work on automating the process. Picked out 4 possible stocks and chose only one. I have decided to invest only in Australian based business in this portfolio and will limit exposure to sectors to leaders and not followers (iron ore)

Integral Diagnostics Limited (IDX.AX): Australian Healthcare. Added to ASX Portfolio on price to sales screen with 48% to go to reach 52 week high.

Hedging Trades

Watched a good techncial analysis video clip from MoneyZG on rates - that got me thinking about my hedging approach on interest rates. This is the sort of chart he was talking about - I have charted the Eurodollar Futures with the current contract in front.

The chart is futures price (yield is 100 minus the price) and shows the massive rise in yield (i.e., fall in price) from late 2021 and what now looks like a bottoming out (lows on October 20 and November 4) - we have not seen price make a higher high for the last 3 cycles - now we have one

https://www.youtube.com/@MoneyZG - good technical analysis from the top down on markets and then crypto

I used that thinking to consider going back to ratio put spreads on US Treasuries - my sneaky feeling is the Federal Reserve may stick with the 50 basis points one or two times more than markets expect.

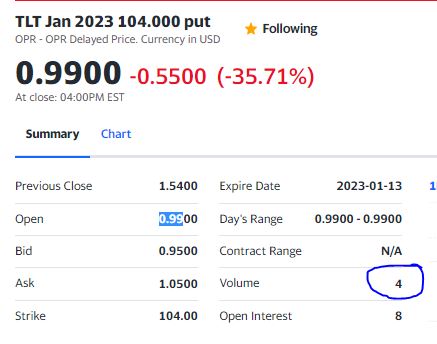

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With price opening at $108.37 and moving strongly during the day up 2.36% (Dec 7), put in place a 107/104 cash neutral ratio put spread. This offers protection for a price drop between 2.3% and 5.2%. I picked expiry one month - so not to the normal monthly options expiry. As the trade is cash neutral, I do not mind if price does not drop less than 2.3%

Quick look at the chart shows the bought put (107) as a red ray and the sold put (104) as a dotted red ray with the expiry date the dotted green line on the right margin. A few key pointers - price turned later than the Eurodollar Futures (Oct 24 and Nov 7) and made a higher low then and another one since. The sold put is below the last reversal bar (Dec 5). Best trade outcome is for price to finish below 107 and above 104.

Of note is on the day, my trade on the sold put was the volume for the day and I got paid commission as the market maker for the day.

Vanguard European Stock Index Fund (VGK): Europe Index: With price opening at $56.52, put in place a January expiry 55/53 cash neutral ratio put spread. Price has passed the August 2022 high in the last week suggesting the bad inflation news is already priced in = not a comfortable place to be short the market. However price has dropped 2% this week - maybe it will drop a little further and worth hedging. My sense is it could bounce - hence doing the ratio put spread. If it bounces, I will buy back the ratio and leave a bear put spread as a hedge.

Cryptocurrency

RUNE (RUNEETH): Averaged down entry price on this Rising 10 Altcoin.

Price has twice tried to break the downtrend followed by a consolidation period - and ignoring the pump spikes has now made a higher high. MACD was indicating divergence a few weeks ago when I first looked. My entry is 31% below my original entry.

EOS (EOSETH): Got an email from Binance offering a cash back deal for making a trade - made a trade in my wife's account. Chart shows a classic bottoming out after a long down trend with a retest off support - moving averages look like they will cross over

Income Trades

Seven covered calls written all in pension portfolio (UK 1 Europe 2 US 4) mostly for January expiry.

Naked Puts

Coeur Mining (CDE): Silver Mining. With price opening at $3.25, kicked the can down the road to March 2023 on strike 5 sold put. Locks in 20% profit on the buy back and was cash positive trade.

Deutsche Bank AG (DBK.DE): German Bank. With price opening at €9.90, kicked the can down the road on 10.8 strike naked put. Locks in 29.2% profit and was a cash positive trade. I am confident that price will pass €10.80 in due course.

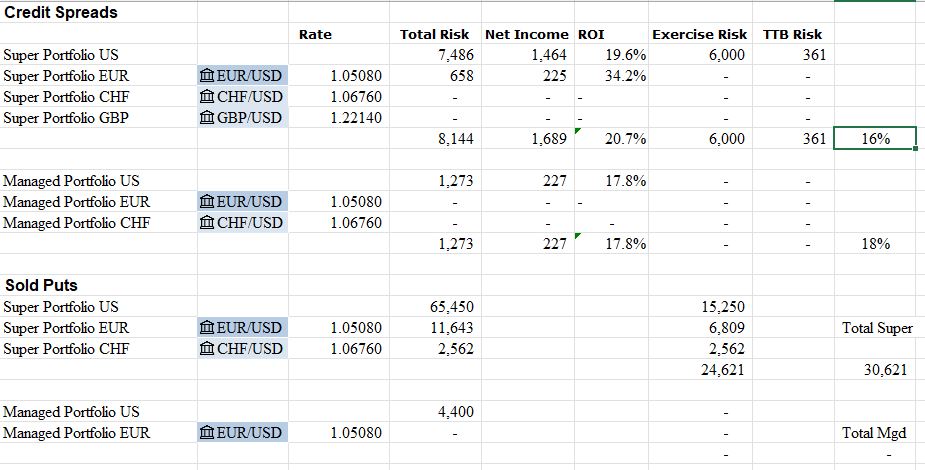

Credit Spreads

Microsoft Corporation (MSFT): Software. AAPlus ran a video call for the week and highlighted 3 stocks for new members to consider. I added a credit spread on one as I do not have any holdings. The talk was about potential into 2023 and there is some risk of recession hitting PC sales. That had me aiming to be some way out the money. With price closing at $247.40 (Dec 8) I went for a 230/215 spread for a modest 17.8% ROI and 7.6% price coverage at trade time (now 6.7%)

Other spreads added

Cboe Global Markets (CBOE): Financial Markets. 13.6% ROI with 7.1% price coverage (3.7% now)

Engie SA (ENGI.PA): French Utility. 29% ROI with 3.1% price coverage (2.7% now)

11 credit spreads open with one at risk of exercise (YOU) and one TTB (XLE). Naked put exposure has mostly been pushed to January and beyond with only two due to expire in January (ABN.AS and CSGN.SW)

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

December 5-9, 2022

Posted Using LeoFinance Beta