TIB - An Investors Journal #633 - Europe Banks, UK Utility, US Oil, Marijuana, Alternate Energy, ASX Stocks, Asset Management, Altcoins (CHZ, FTM) + more

This was a week for averaging down entry prices, on which timing was perfect, and for following up on a few AAPlus ideas. Also worked out the next phase of an ASX strategy using a low cost share trading platform

Portfolio News

In a week where S&P 500 rose 1.14% and Europe rose 1.91%, my pension portfolio rose a more modest 0.71%. The drags were European Banks and Japan and big drops in Solid Power (SLDP) down 28% - new CEO did not thrill the markets - and Stem Inc (STEM) down 14% on the week with no news.

Big movers of the week were Stuhini Exploration (STU.V) (+27.7%), Latin Resources (LRS.AX) (+20.8%), Tilray Brands(TLRY) (+19%), Canopy Growth Corporation (WEED.TO) (+18.5%), Bod Australia (BOD.AX) (+17.2%), JinkoSolar Holding (JKS) (+16%), ETFMG Alternative Harvest ETF (MJ) (+14%), Wynn Resorts (WYNN) (+13.6%), American Rare Earths (ARR.AX) (+11.6%), Cronos Group (CRON) (+10.5%), Hecla Mining Company (HL) (+10.4%)

The standout theme for the week is marijuana with 5 stocks in the list - somehow I had a feeeling and did the averaging down before the big moves. Two silver mining plays too as US Dollar weakens as Tresury yields slide a small amount.

The move in Latin Resources did remind me to exercise options - report that next week.

President Biden did sign the Marijuana Research Bill which will facilitate more research into the uses of cannabis. Meanwhile sales are climbing.

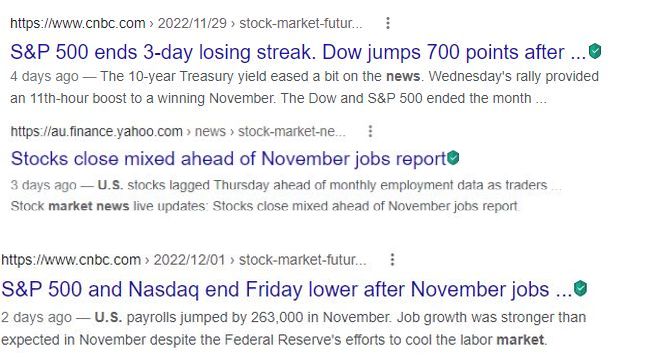

US markets were keen to move ahead on the back of Fedspeak about the potential of moving to smaller rate hikes.

The jobs report on Friday put a dent in that feeling as jobs are stronger than expected meaning the pressure for wage inflation could continue

Crypto Recovers

Bitcoin price had a quieter week with a trough to peak range of only 7.5% - there are a few buyers around the $16k level - not a lot - just a few to push price up 63% on the week

Ehtereum again traded in a range trough to peak almost double ending the week just over 9% up. The 4 hour char is showin the 2nd up cycle

Most important move in my portfolios is HIVE up 40% from the lows. It is my largest crypto holding

Bought

Credit Suisse Group (CSGN.SW): Swiss Bank. Did the contrarian thing and averaged down entry price on my holding - doubling up. If Saudi National Bank was prepared to invest at SFr 3.82, I was happy to enter lower. My entry price at SFR 3.04 is another 10% lower than last week's record close. Tried to write covered calls onthe new stock but the broker was not allowing it - something to do with being unable to calcualte margin requirements. There is a secondary right issue for exisitng holders which will be priced much lower at SFr 2.52 - it looks like those rights are not exercisable by investors resident in certain jurisidictions of which Australia is one. The rights can be sold - too bad I did not work that on day one as rights halved in value within 3 days of listing. Accounting for it as a return of capital

Centrica plc (CNA.L): UK Utility. Replaced portion of stock assigned on covered call at November options expiry closing price at 24% premium to what I was assigned at. Price has popped as UK Government raised the threshold for the windfall tax - less tax to pay. Am sure hoping that the UK Government does not put a cap on natural gas pricing. Dividend yield 2.09%. Wrote covered call for 1.07% premium with 7.5% price coverage. I will keep pushing this as an income trade as income has far outweighred the capital losses (by 39%)

Tilray Brands (TLRY): Marijuana. Price looks like it has bottomed out after the long decline. Averaged down entry price doubling holding in one portfolio - might look to add more. Wrote covered call at 1.31% premium with 57% price coverage.

Canopy Growth Corporation (WEED.TO): Marijuana. Doubled holding with chart looking much the same as Tilray - price bottomed out, moving averages have changed direction, price made higher low and higher high. Wrote covered call at 3% premium with 29% price coverage. I chose the wide coverage as I have holdings from way back that are under water. It is a good thing as price moved in this portfolio 23%.

ETFMG Alternative Harvest ETF (MJ): Marijuana. Dividend yield 3.31%. Wrote covered call at 2.3% premium with 25.7% price coverage. I chose wide coverage for the covered calls on marijuana stocks as I am covering the new holdings and the holdings that are well undeer water.

L&G Hydrogen Economy Ucits Etf (HTWO.SW): Alternate Energy. Averaged down entry price. The chart shows price cycling on a downtrend but not a higher low or higher high. Trade looks like a wishful thinking trade.

This is listed in Switzerland in Swiss Francs. It is time to explore alternatives - I will look at the components and also see if I can find a way to write covered calls to get some yield.

Commerzbank AG (CBK.DE): German Bank. Used a down day to average down entry price on the small holding I have. Added to the exisiting covered call for a misery 0.38% premium but with a whopping 12.4% price coverage.

Deutsche Bank AG (DBK.DE): German Bank. sed a down day to average down entry price on the small holding I have. Added a new covered call for entire holding for 0.89% premium with 5.8% price coverage.

Gemfields Group (GEM.L): Gem Mining. Averaged down entry price after price made the big movers list alst week.

Amazon.com (AMZN): US Retail. AAPlus idea to add. Bought 100 shares in my pension portfolio - already holding in the managed portfolio. Wrote covered call at 1.19% premium with 8.3% price coverage.

ChargePoint Holdings (CHPT): Electric Vehicles. Scaled into position on AAPlus topping up - they feel the chart is bottoming. Wrote covered call at 0.95% 29.8% - kept the coverage wide to cover the higher average cost than this entry.

Hecla Mining Company (HL): Silver Mining. Scaling in. Wrote covered call at 1.99% premium with 9.4% price coverage.

Nordic American Tankers Limited (NAT): Oil Shipping. Scaling in. Wrote covered call at 2.87% premium with 14.7% price coverage.

Nokia US ADR (NOK): Network Equipmnet. US Administration formally banned Huawei and ZTE from rolling out infrastrucure in US. Nokia has to be a winner from this as a credible alternate 5G supplier behind Ericcson. Wrote covered call at 0.84% premium with 5.8% price coverage.

PayPal Holdings, Inc (PYPL): Payment Services. Rounded up holding to 100 shares t be able to write covered calls - AAPlus added Amazon and UPS on expectations of more online shopping in the upcoming holiday season - PayPal will win too. Wrote covered call at 1.11% premium with 9.1% price coverage.

United Parcel Service (UPS): Logisitc Services. AAPlus idea to add - added a small holding and a credit spread.

Vulcan Materials Company (VMC): Building Materials. AAPlus added to their holdings so I added another small parcel working steadily to get to 100 shares.

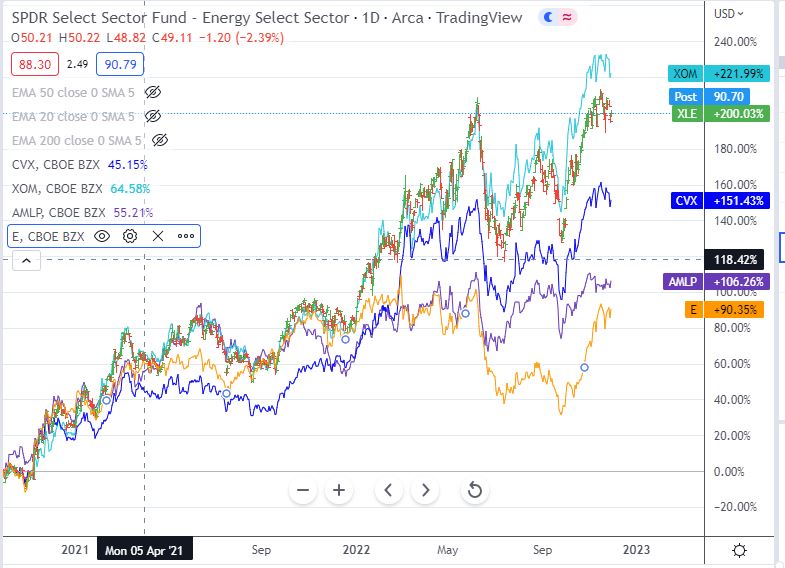

Energy Select Sector SPDR Fund (XLE): Energy. AAPlus idea. Looking at the detailed holdings 45% is held in the three major US oil companies (Exxon, Chevron and Occidental). Dividend yield 3.4% Wrote covered call at 1.17% premium with 4.9% price coverage.

I saw the idea and bought the stock and a credit spread. I have done some comparative charts against the two main constituents and included stocks I am holding - Alerian MLP ETF (AMLP - purple line) and Eni (E - yellow line). Seems that all I had to do was add Chevron (CVX) which was the relative underperformer. I do like that I can buy 100 shares and write covered calls for under $10k

Alerian MLP ETF (AMLP): US Oil. Following the analysis I did on oil above, I added this ETF to the managed portfolio - already have it in my pension portfolio.

Elmore was Indiore was NSL (ELE.AX): Base Metals Mining. Averaged down entry price in pension portfolio on reviewing annual activity report. This business has morphed into a base metals miner based in Australia with interest in copper and zinc - just what I want to hold.

Panther Metals Ltd (PNT.AX): Zinc Mining. Added to my portfolio at same price from last entry - scaling in.

Abbott Laboratories (ABT): US Pharmaceuticals. Been waiting to make another nibble to average down entry price when price shows signs of breaking the downtrend. It has done just that making a higher high and a higher low with 20 day moving averaging breaking above the 50 day.

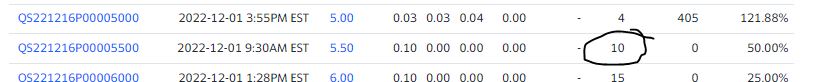

QuantumScape Corporation (QS): Alternate Energy. Watched an investor pitch video about the Forever Battery - a solid state battery. Pitch did not include the name of the supplier or the key materials - a bit of Google got me a few names - added this one as I am already invested in Solid Power (SLDP). Also set up a credit spread. Of note is my bought 5.5 strike put on the credit spread was the market volume

https://www.ai4beginners.com/3-hot-solid-state-battery-stocks-for-2022/

Transocean (RIG): Oil Drilling. Replaced portion of stock assigned in October at 23% premium to assigned price. Looks like the broker got me a bad spread price as I bought in the first minutes of trade at $4.33 and stock closed at $4.07

Sold

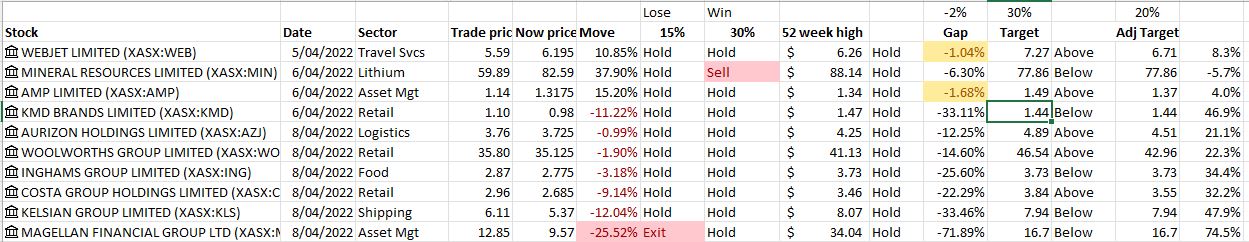

Magellan Financial Group (MFG.AX): Asset Management. Implemented stage one of a new ASX strategy in my Sharesies portfolio = cull the losers. Still working out at what level to cull - thinking 15%. As this was the first it was a larger 23.1% blended loss since April/November 2022. The November transaction was a top up when I added new funs - I topped every stock up. Now the Magellan story is a shambles - the company is undergoing a change of direction and will look to replace its entire board soon. Time to bail out.

AMP Limited (AMP.AX): Asset Management. Profit taking sale close to 52 week high for 22.6% blended profit since April/November 2022. Proves the screening system can work as AMP has been in a beleaguered state since the Royal Commission and some management problems leading up to that.

ASX Strategy - Sharesies

Did some more work on an approach for my ASX portfolio on Sharesies. What I like about using Sharesies is I can buy small parcels of shares even down to part shares with low trading costs (0.475%).

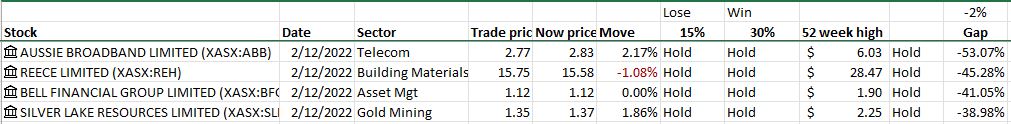

My tracking spreadsheet is getting smarter to give me pointers of action to take at a glance. I learned all about conditional formatting to do the highlighting

- Sell stocks that have reached 30% growth or touched 52 week high (Red Sell cell)

- Sell stocks that have lost more than a set percentage. Will use 15% for future trades. (Red Exit cell)

- Adjust targets for stocks that were bought close to 52 week high. Set the sale order when the gap is 2% or less (Yellow cells). Adjustment percentage is 20%.

Consistent with this - sold Mineral Resources (MIN.AX) for profit; sold Magellan Financial (MFG.AX) for a loss; set sale orders for AMP (AMP.AX) and Webjet (WEB.AX)

Still working out approach for redeploying proceeds from sales. 3 models come to mind.

- Run the screen again and invest in any new candidates

- Invest across any laggards that are in the portfolio

- Invest in the leaders as they are already proving their position

Need also to think about position size - thus far I have standardised the position size at $200. Topping up would change that and make it harder to do apples and apples at a glance. Currently I have less than $200 avaialble - invest or spread or wait?

Later in the week, I decided to turn it into a scheduled investing plan - add in $1,000 a month at the start of the month. Will kick around ideas on how to do that - thought is to scale in the winners equally - say $100 each - that does mess the apples and apples - will have to compare percentagees. OR add new stocks at standard size. With only a few rounds, I am already at 32 stocks - that might be too many.

I decided to add new stocks at standard position size - ran the screens and calculated the distance to 52 week high - picked the stocks with the biggest distance. The mix of sectors are a bit challenging if there is talk of a recession on the way

So the strategy for building a portfolio is to pick stocks that are somewhat beaten up on a valuation basis but are showing technical signs of breakout and focused on the ones furthest away from 52 week high. Exit is at 15% loss or 30% gain or 52 week high.

Cryptocurrency

Chiliz (CHZBTC): Pending order to buy at previous reversal low hit. Have put in a target for selling at 50% profit. I must say I am surprised the chart looks the way it is as CHZ is used for a lot of football (soccer) teams - would think interest would be high during the Football World Cup in Qatar.

Fantom (FTMETH): Price has been bottoming out and looks like it wants to break higher - chart shows price on BTC chart as earlier trades were made selling BTC.

Income Trades

Caught up on income trades in my pension portfolio writing 44 covered calls acroos teh portfolios (UK 1 Canada 2 Europe 3 US 38) with 5 credit spreads (Europe 1 US 4). One naked put written on Nokia (NOK)

Credit Spreads

Spreads exposure is looking tody ths far but target ROI in the pension fund is a low 21% - wrote a few that had spreads to wide with low ROI's = still learning. Naked put exposure is managemeablke but does include two uglies - Credit Suisse (CSGN.SW) and Couer Mining (CDE). Crdit Suisse is the hard one to kick down the road as theyre are limits on trading options while they go through their capital raising.

Currency Trades

Sold US Dollars and Euros to fund Swiss Franch purchases.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

November 28 - December 2, 2022

Posted Using LeoFinance Beta

Congratulations @carrinm! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!