TIB - An Investors Journal #630 - Nickel Mining, Base Metals, Altcoins (LTC, ADA)

Markets bounce with a better than expected inflation report and crypto crashes made it feel like a sensible week to stay away from markets in the week before the next options expiry.

Portfolio News

In a week where S&P 500 rose 5.89% and Europe rose 8.27%, my pension portfolio rose only 4.6%. The drags were Europe banks, interest rate shorts, oil and solar apart from Sunpower.

Big movers of the week were Fiverr International (FVRR) (+41.5%), Yooma Wellness (YOOM.CN) (+33.3%), Castillo Copper (CCZ.AX) (+30%), SunPower Corporation (SPWR) (+27.4%), Stroud Resources (SDR.V) (+26.7%), Canopy Growth Corporation (WEED.TO) (+26.1%), 3D Systems Corporation (DDD) (+24.8%), Adyen N.V. (ADYEN.AS) (+24%), De Grey Mining (DEG.AX) (+21.4%), PayPal Holdings (PYPL) (+21.1%), Applied Materials (AMAT) (+20.5%), Aurora Cannabis (ACB.TO) (+17.1%), Arafura Rare Earths (ARU.AX) (+16.4%), POSCO Holdings (PKX) (+15.8%), Barrick Gold Corporation (GOLD) (+15.8%), NVIDIA Corporation (NVDA) (+15.3%), Navios Maritime Holdings (NM) (+14.6%), Global X Social Media ETF (SOCL) (+14.4%), Airbnb (ABNB) (+14%), iShares STOXX Europe 600 Technology UCITS ETF (DE) (+13.6%), Warner Bros. Discovery (WBD) (13.5%), VanEck Gold Miners ETF (GDX) (+13.4%), Stem, Inc (STEM) (+12.9%), Honey Badger Silver (TUF.V) (+12.5%), Eneti Inc. (NETI) (+11.7%), Northern Dynasty Minerals (NAK) (+11.3%), Mineral Resources (MIN.AX) (+11.2%), Citigroup (C) (+11.2%), Livent Corporation (LTHM) (+11.1%), Amazon.com (AMZN) (+10.8%), IGO Limited (IGO.AX) (+10.8%), Safe Bulkers (SB) (+10.7%), Dawson Geophysical Company (DWSN) (+10.5%), GoGold Resources (GGD.TO) (+10.5%), Wynn Resorts (WYNN) (+10.1%)

This is a broad based set of big moves with some discernible threads - marijuana stocks on the back of midterm election results, gold and silver mining, bulk shipping, lithium and solar power on the back of California feed in tariff changes, base metals. There are some deal and news specific moves too - e.g.. Arafura signed feed offtake deal with Hyundai, Warner Bros sped up rollout of streaming service, China relaxed some Covid-19 measures good for the gaming stocks.

Markets were a little apprehensive ahead of the mid-term election but were soothed by the softer than expected inflation report which drove eh biggest one day rally in two years.

I have to say, if you told me a year ago that the markets would surge 5% in a day on the back of a 7.7% inflation read, I would have said you were barking mad. 7.7% is above the long run return on stock markets.

Barrick Gold

Breaking news (Nov 13) is that Barrick Gold (GOLD) may be eyeing De Grey Mining (DEG.AX).

My pension portfolio has a large holding in De grey - would be sad to see the huge potential of its Pilbara tenements diluted by the other Barrick Gold holdings. I do hold GOLD shares in my managed portfolio.

The article is behind a paywall - I am a subscriber - not a great article and a bit short on data.

Crypto Busts

The news of the week was the dramatic collapse of crypto prices following the troubles at FTX exchange - losses were broad-based with all the scared money deserting the ship.

What struck me was a small news item which just happened to break on Monday in US. The Supreme Court ruled in favour of the SEC in its case against LBRY, saying there sale of LBRY tokens was illegal as the tokens are deemed to be securities.

This case has major ramifications for the whole industry. LBRY is a minnow in the pond with a market capitalisation of only $9 million and does not have the financial muscle to fight back for long (it took two years). The SEC has a case pending against XRP - win that and the whole industry is under pressure to access US markets.

https://decrypt.co/113754/lbry-loses-sec-case-dangerous-precedent-crypto

My chart at the time shows the timing of the release of he LBRY news and the BTC price. Maybe it was just a coincidence.

Bitcoin price was smashed with a 21% drop from the open - dropped and kept dropping - note it has stayed below the medium term resistance level that sits around $18k

Ethereum dropped harder with over 30% down but found buyers to lose about the same as Bitcoin on the week

Biggest casualty in my holdings was Solana - down over 50% - my holding is small.

Bought

I have held off investing any of the Australian Dollars proceeds from selling my house while the market has been working out where the bottom is. I started to run stock screens this week to check what was showing life. I have 3 screens I use Price to Book less than 1, Price to Sales less than 2 and Price Earnings less than 10. Stocks need to have made a 30 day high and be over a certain size. A few stocks emerged on the screens this week - bought two for my own portfolio

Nickel Industries Limited (NIC.AX): Nickel Mining. I have been looking for nickel exposure as part of battery investment theme. This business operates mines in Singapore and Indonesia. Chart shows price breaking the downtrend and making a higher high.

Dividend yield 4.49% was a surprise.

South32 Limited (S32.AX): Base Metals. It has a portfolio of assets producing bauxite, alumina, aluminum, copper, silver, lead, zinc, nickel, metallurgical coal, manganese, ferronickel, and other base metals. Chart shows price breaking the downtrend and making a higher high.

Dividend yield 8.37%

I did transfer some cash to my personal Sharesies account. It is a platform operating in Australia and New Zealand that offers low cost and partial share participation in markets. I will run screens next week and start deploying some of the spare capital - in a small way.

Cryptocurrency

With the big selloff in crypto markets I was keen to find coins that were rising relative to Bitcoin or Ethereum - i.e., not falling as hard. I also had a trading credit available from Binanace on my wofe's account - never look free money in the mouth. As here account was built from mining Ethereum I was looking at ETH pairs

Cardano (ADAETH): Price has broken the downtrend and made a higher high above the resistance level at 0.0002711. Opened a modest $100 holding (Nov 9).

Litecoin (LTCETH): Chart is quite different with price breaking below the consolidation zone it was in for a month and reversing when Bitcoin and Ethereeum were smashed to break above the zone. Yellow ray is the new entry for this portfolio.

In my own Bittrex account, pending order to sell LTC for ETH was hit for 50% profit. It is the red ray above the pricing showing on the Binance chart where I bought LTC in my other portfolio and is 50% profit from the blue ray below.

The Bittrex chart shows the spike that price hit. My exit was right at the peak of that spike.

Income Trades

Covered Calls

Stayed out of markets with only 5 covered calls written (all US) and one naked put also US. Of note was the covered call on Autonomous Vehicles ETF (DRIV) - my trade was the volume for the day

Naked Puts

Aegon N.V. (AGN.AS): Dutch/US Insurance. With price opening at €4.69, bought back November expiry 4.8 strike naked put for a 78% profit from the last roll out. This trade was part of a December 2022 5.5/7/4.8 call spread risk reversal on which the sold puts have had 3 roll outs of which one was at a loss. The net premium on the call spread is now positive at €0.13 and not yet in-the-money. One more adjustment needed to bring this back to profit or hope price rises above €5.50 in 6 weeks.

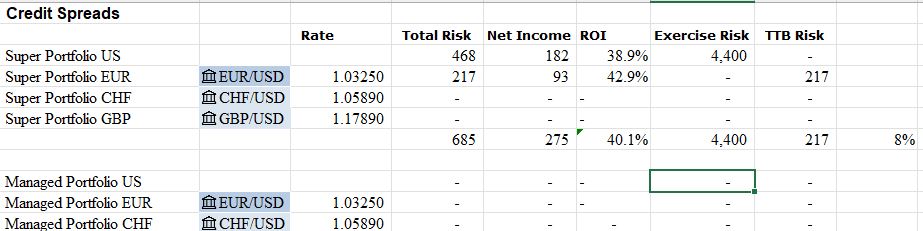

Credit Spreads

As I was travelling over last options expiry, I chose to stay away from writing credit spreads - there are only two outstanding with expected ROI of 40% already showing only a likely 8%. 8% every month would not be a bad outcome.

Currency Trades

Australian Dollars (AUDUSD): Sold US Dollars to replace AUD used by the broker to cover options exercises last month.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

November 7-11, 2022

Posted Using LeoFinance Beta