That Time... Again

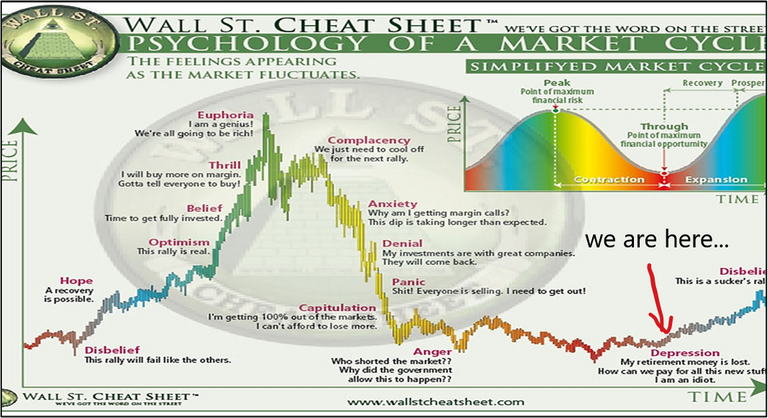

Throughout my experience of putting out content in the @leofinance community, I have quite a few times brought the Wall Street cheat sheet into the discussion at different times of the crypto market and such types of posts have always ignited engagement from the community.

People like to guess, otheriwse plenty of our mundane discussions wouldn't even exist because most of our talks are not based on facts, but perceptions, and guesses at most. Whenever I put out such #askleo posts about where BTC might be on the Wall Street cheat sheet there has never been a consensus.

And I love that because certainty is definitely not a part of my life and approach to life. Certainty is a dream killer... but anyway... Today we're looking again at the famous Wall St. pattern for markets and trying to guess where BTC could be at on that chart...

It could be anywhere ;), considering how unpredictable life and the markets have become but, my take is that BTC's price chart right now is somehow replicating the final stages of the "depression phase" from the famous above-mentioned sheet.

And let me tell you why...

A few months ago when FTX nuked Bitcoin's price(it could have been anything else, it had to happen) everything fell off the sky. You know the saying: when Bitcoin coughs altcoins get a fever. Seeing my portfolio losing value so drastically and in such a short time and my Hive payouts decreasing that much clearly "made a hole in my soul".

However, what made all this shit even more painful was the fact that this was no ordinary whale-orchestrated dump... BTC recovered a tiny bit of the losses, short term, but nothing spectacular and not too fast. It was more like a crawl than a steady climb. Alts bled a lot, HIVE included, and being a person who lives off blogging meant that "depression was upon me" from that stage.

Thoughts of starting all over, moving away, searching for work, getting abroad, and reminiscing on the potential profits that I had in 2021 and other similar gray thoughts have tortured me for some good weeks, if not months. The depression phase of a market, if not properly prepared for it, can be "soul-consuming".

Recently we've had a quite decent rally in the market and although not all alts have managed to keep pace with BTC's recovery, they sure will once an altcoin season will kick in. As you can see, BTC is holding most of the gains it harnessed in the past week or so, and the bear market might be over.

It was about time, though, after 14 freaking months of an almost continuous downtrend. Although more than a year ago I was no longer a believer of past patterns repeating for the crypto market, it has been proved to me that halvings still "decide the course" for BTC, and as in previous occurrences Bitcoin bottomed at a bit over one year after its peak.

Now what?

Now it's time we should put charts away, love our lives again, do our thing on Hive, keep pushing this chain to mass adoption, and ride the waves of crypto till like one year after the halving when will probably be a good time to dump. Write that on a wall, so you don't forget to take profits next bull market. I sure am doing that...

Thanks for your attention,

Adrian

Posted Using LeoFinance Beta

https://twitter.com/3018665008/status/1614954948508192768

The rewards earned on this comment will go directly to the people( @acesontop ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

You might be right and many people share your opinion. So maybe this time there is consensus? (and that might partially explain the recent rally)

However, there is still potential for further crashes. And the end of the depression might still have to wait for another year.

We will know when we tell ourselves: Had I only bought more at that time...

Posted Using LeoFinance Beta

Certainly these 14 months that have passed have been very hard times for the crypto market, but I think that better times will come, and I think they are already beginning to appear.

The truth is that I feel very identified with what you say. 2022 was a real disaster for my crypto finances, and I came from a 2021 in which things went quite well for me. We do not know how everything will be exactly, but understanding that 2024 is the year of the HardFork for Bitcoin and that Bitcoin is the queen that moves everything in the market, then we can intuit that a few months of positive movement are coming. However, caution is important, because nothing is written.

And as you well said, in the next bull market we must try to take profits on time, because it is something that almost all of us tend to forget in the midst of the bullish maelstrom and then come the regrets.

Posted Using LeoFinance Beta

Make a strategy and stick to it. Don't set too insane targets but don't go too low either

Welp, in my opinion, there are two potential places we could be. We're either coming out of the Depression stage and entering Disbelief, or we're still in Denial and the Panic and Capitulation are still coming.

Unfortunately, we won't know until after the fact. But, I will say, that it seems to me the longer this rally sustains itself, the more likely we're in Disbelief and Capitulation is behind us.

As I said somewhere else, a case can be made that the FTX debacle and Bitcoin plunging below 20k down to 15k was the panic/capitulation. But, again as we all know, Bitcoin rarely does what everyone expects so...?

Hopefully, we've seen the bottom and we've entered Disbelief. I know I, for one, have a hard time believing this is the beginning of another bull with all the negative economic news still to come.

Time will tell.

Posted Using LeoFinance Beta

I hope you are right. But i think there is the possibility that the phase of anger ist just a few days behind us…

That was a long time ago imo. It's 14 months since the ATH. How long do you expect the bear market to last?

Thats the one question… we will see 😃