Is Bitcoin Losing The Mojo?????

A little more than a month ago, the knock on Bitcoin was that the transaction fees were too high.

Due to a variety of factors, we saw Bitcoin drift up towards $40 a transaction. This caused many naysayers to start the mantra that Bitcoin was dead (again).

Since that time, with the introduction of SegWit and it being embraced by Coinbase and Bitfinex, the fees have come back to a normalized level. Of course, one would think lower fees means more activity.

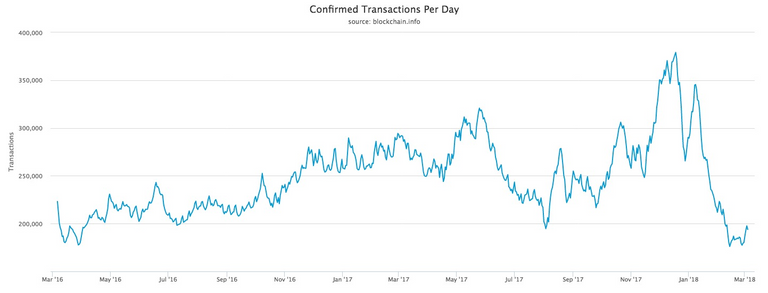

Not according to the data from Blockchain.info. At the end of February, Bitcoin transactions hit the lowest level in almost two years.

https://cointelegraph.com/news/bitcoin-transaction-volume-hits-two-year-low-despite-rock-bottom-fees

What is the reason for this?

Part of the answer could lie in the fact that with the price of Bitcoin off 45% from the high, people simply are holding onto their Bitcoin. This would make sense since the Bitcoin crowd tends to be very emphatic about their view on things. Those who are HODLers, will do so through any ups and downs.

Another possibility is the fact that other blockchains are coming online, thus providing better alternatives.

Ironically, as a percentage of market cap, in spite of the low number of transactions, Bitcoin is back up to 42%. This is the highest it has been in a while with the bounce off the bottom greater than that of the alt-coins.

Ultimately, I still feel Bitcoin will be more of a store of value than a regularly used currency. Digital gold might be the most accurate description for it.

If you found this article informative, please give it an upvote and rehive.

More and more people are becoming aware of altcoins.

Personally.... I think the vast majority of the purchasers of Bitcoin were just out to make a quick buck... and now that the last couple of months have corrected the cryptocurrency market, they're not interested anymore.

I'm very confident that once crypto gathers a bit more momentum we'll see an increase again... the question is, do we want these bandwagon-jumpers? Also, we couldn't stop them regardless how we answer. ..

They'll be back in June. Get ready for bull-run central.

Hahaha, should we move this party to Spain?

What's happening in June?

Father's Day?

"Thanks kids... I'll put this Bitcoin with all the other Bitcoins you've got me over the years... this one looks like a good one.... although, kids, I have to say, I miss the days when you were getting me socks and undies..."

Bitcoin or a tie...

Tough choice....

EOS comes out it June.

Casper might come out in the summer.

We might have SMTs by then.

Lightning network?

There are a lot of things coming out around that time in addition to the summer time pump and dump.

Ahhhhhhh..... excellent! Well, thank you for this... I look forward to getting caught up in all the FOMO.

You always come with a great information thanks for sharing this gretat information keep it up

I just don't know why something is more valuable as a store of value if it has less utility as exchange. I want both, because I can have it.

IMO Bitcoin's value comes from brand recognition because it was the original blockchain. I look forward to the day when there is no such thing as "Bitcoin Dominance"

It is mainly the name, and that is very important because many people who are just starting out in the market, only know Bitcoin, and therefore invest their capital in it, it is practically the main form of capital input to the market.

While Bitcoin remains being the core of the market, then there will be no true decentralization.

The other factor Bitcoin has is liquidity for big players.

Someone is not going to dump $50M in STEEM with only a $1B market cap...they can do that with BTC and still be able to get out if need be.

I dont know why either but that is how it seemed to work.

Gold, itself appears to be a much better store of value than exchange.

People value what they value.

I guess it comes down to if something have value I want to hold onto it...especially if it could go up.

I think you hit the nail on the head with "digital gold". I also think people are becoming more attracted to all the new block chain options. I am surprised to learn it's at 42%, though

That is according to Coinmarketcap.com.

It was down as low as 33% if memory serves me right.

The bounce of the low was fairly powerful for BTC while the altcoins have no had the same jump.

Is anyone else freaked out by everyone's eyes in this image?

I think a lot of the people who were out to make quick money are gone now, taskmaster.

Us crypto investors are a different animal. I’m HODLing right now, and I know others who are just waiting for the next bull run!

Yes. No more 1000% yearly gains only 500% or less. lol

Agreed - I think the huge volatility in the stock markets has people fleeing to other types of assets (e.g., gold, BTC, commodities, etc.). As a result, you're actually seeing the correlation between BTC and other alt coins fall. Last I checked, BTC and ETH were only correlated around .6 in terms of movements (down from .8 last year).

I don't hate this though since it allows me to invest in BTC as a store of value, as you noted, and ETH as more of a technology and blockchain platform. Great post.

Although it's tempting to say that it's because people gave up, I think you're right in that it's more a store of wealth, so people don't want to spend it. Especially if people bought at a higher level than where we're at, they're going to need to HODL until they're profitable. At that point, if they're still anticipating it going up further, why would they sell unless they needed to? There are many networks coming out (or are out) that can do transaction faster and cheaper, that it doesn't make as much sense to use Bitcoin unless the person on the other end of the transaction doesn't have access to the alternatives.

Why is that girl grabbing that guy's junk and is that an alpaca or a llama behind the Bitcoin?

$40 a transaction seemed a bit high. Was that for any amount? Thanks Task. 👫

Transactions on blockchain are not in amounts but in data sizes...so $40 was for $1 or $1M....it was based upon the miners fees at the time.

And why are you spending time analyzing the damn picture. LOL

But good catch on her grabbing him in the pic...a little hentai on the STEEM blockchain.

DPorn has nothing on me.

You might have to re-tag nsfw. 😂

I don't know what it is, I just notice stuff like that. I do the same thing when it comes to TV commercials. It's prolly a perv thing. 😂

I agree about the store if value. It will be interesting to see the impact of the lightning Network as it relates to using Bitcoin for day to day transactional purposes.

Roger Ver's latest video disagrees with this

need to see the days of $1000 btc... then it wouldve lost its mojo. Until then #moon

I could see BitCoin being considered digital gold, for storage. It defiantly seems like that's what it is being used as at the moment. Steem though is pushing away storing stuff in BitCoin, since saving Steem has advantages.

This could be the beginning of Bitcoin being considered a store of value rather than payment mechanism. If you look at most stores of value they aren't exactly liquid. However with the history of bitcoin, for all we know it could be a totally different story next month.

Most likely reason 1 is more accurate at the moment. No one wants to be the "fool" that sold all his BTC at the "bottom".

However reason two is also legit. Overall activity on the various blockchains has fallen ( excluding Steem).

The irony is that steem ( SP) is a better and safer store a value; with a bigger potential ROI :)

What drives this high volatility? Skepticism, random concerns, or skewed market forces set to completely crash the market?

Just take the "g" out. It's digital OLD! :)

In my opinion there are three reasons for low volume of tarnsactions of Bitcoin despite having toped market captilization table.

I was thinking of this not so long ago. My take is the combination of the factors you named. Let me explain.

When people first come to crypto - they start with bitcoin. When people get familiar with altoins - they face the need to transfer bitcoin to exchange to trade alts.

Before November 2017 majority of people didn't pay attention to the crypto they used for transporting value between exchanges (or wallets). BTC was the default choice due to:

It was all good until people faced extremely high fees in November-December 2017. Masses tried to use other means of value transferring, like ETH, LTC, STEEM and others. They tried it and they liked it: orders of magnitude lower fees and orders of magnitude faster transactions. This experience will never let them come back to slow and expensive BTC for transfering value purposes. BTC has narrowed down all of its use cases to just store of value. Would you agree?

HODL Gang

HODL Gang

I just listen this song.

BTC is always in leading position, rest of the coin are copycat.