Are we there? Is it time to build (a snowman)?

When we unleashed the pandemic back in 2020, states and central banks around the world stepped in and contributed with fiat currency, zero interest rates and more money available than ever before. Money was cheap, loans were easily available, and it was a terrific time to invest in growth-oriented industries. Behind the upswing, inflation concerns were simmering, and several well-known investors sought something scarce to put their money in. The new favorite, especially among big investors, was bitcoin. Bitcoin is unique on many levels. Behind bitcoin's code are hidden properties that have similarities with gold and cash. During last year's upswing, it was bitcoin's digital gold properties that attracted investors.

In a climate where interest rates are raised, loans will become more expensive. In addition, inflation expectations in the market are adjusted. Reduced ability to pay increases uncertainty in the market. All these things are clearly bad for crypto. Even though Bitcoin was supposed to be a "safe haven" when there is high inflation, these effects have been the main reason why Bitcoin and crypto in general have had a brutal year.

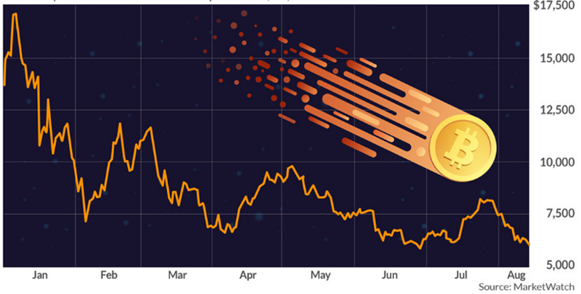

Lately, Bitcoin has fallen in line with the stock market in 2022 for the same main reason – interest rate hikes. Greed, airy- and visionary ideas, seasoned with highly experimental financial theory and lousy risk management by large influential crypto companies, led to a violent period for crypto. The giant collapse of Terra created huge ripple effects that led to the beginning of the crypto financial crisis. The cryptocurrency Terra was an algorithmic stable coin - which was supposed to follow the price of the US dollar - without holding reserves directly in the dollar. The dream was to create a stable cryptocurrency. The attempt failed hard. The Terra collapse led to a direct Bitcoin foreclosure of over 80,000 Bitcoins. Tesla sold down significantly during the collapse and got rid of 29,000 Bitcoins. Furthermore, the ball started rolling, Three Arrows Capital (3AC) started to forcibly sell Bitcoins. An unknown actor, 3AC and the crypto bank Celsius forcibly sold over 100,000 Bitcoins. It was this massive selling that pushed the price of Bitcoin way down.

Bitcoin currently sits at $16,600. The world economy is still unbalanced and inflation shows few signs of calming down. The US central bank and other central banks have communicated that they see interest rates peaking in 2023. At the same time, other markets are showing evidence of systematic challenges, and we have seen the central banks once again intervene in both the British and Japanese markets. This suggests that the world economy is beginning to fall dangerously deeper into an unfavorable balance between systemic risk in the market and escalating inflation. This may indicate that the worst period of interest rate hikes is coming to an end. In addition, this summer's financial crisis in crypto has contributed to a washout of short-term players with poor risk management and heavy dollar leverage. In the aftermath of this crisis, we have seen subtle signs that the co-movement between bitcoin and US stocks is diminishing, and since the last US interest rate meeting, we have seen that Bitcoin has outperformed most other investments. Bitcoin ended the third quarter up 1% against the dollar and is one of the few investments to have seen moderate upside since July. This may point in the direction that the worst is over.

Bitcoin "sacrifices" short-term stability for long-term inflationary predictability, as already written, there will never be more than 21 million bitcoins. This creates the basis for the huge price movements, which are further reinforced by the fact that the crypto industry is still young. The scarcity of Bitcoin makes it exciting over a longer time horizon, and the big fall from November in 2021 may represent a good entry opportunity, although there is of course a danger of further decline. If Bitcoin repeats itself, historically, and this is not unthinkable, now is the time to start building.

We must not forget that Bitcoin's "bear markets" are deep and long. From the 2017 peak, it took 364 days for bitcoin to bottom out after a total drop of 84%. It took 1094 days for Bitcoin to pass the old all time high in 2017. In 2013, it took 407 days to bottom out after a total drop of 85% and 1200 days for Bitcoin to pass the old highs.

It has now been 420 days since Bitcoin reached its last peak and Bitcoin is down around 75%. Bitcoin has now leveled off, and the market has similarities to previous market bottoms, despite the fact that the bottom is not as deep as before. Something to consider.