Bitcoin Price and the Golden Cross. Risks and potential of these market-days

What Market Phase are we entering into has been the introductory question for our last appointments. Are we going to listen to the Bulls or the Bears? Are we going to see a Bull Market or a Bear Market?

Welcome to Surfing the Market, we are already at our 41st appointment and I hope that with these easy tech analysis we have helped you in some forms, even just to evaluate different market perspectives.

Let’s start from our usual weekly perspective

Source: Tradingview - Weekly Chart

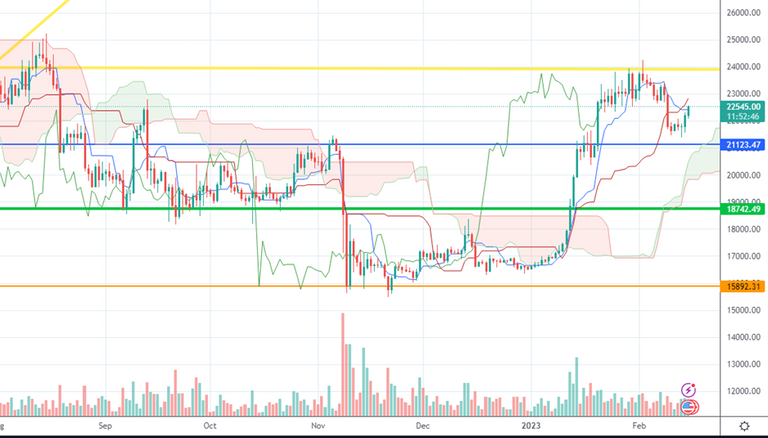

Price got rejected from the yellow resistance that is gaining more relevance. The price dropped to the blue support and we are now rising again. So, the previously identified levels are again confirmed.

What do I expect from a daily perspective?

Source: Tradingview - Daily Chart

After a bounce on the blue support area we are now headed again towards the yellow area, that has been tested for several days but we could not manage to pass it. I am expecting some turbulence in 23k$ area again, but if the volumes confirm the trend, my quietly bullish perspective would be confirmed.

Source: Tradingview - Dollar Strength Index Chart

DXY is resting in the last days, having found a resistance wall in the area 103.5 points. A non-dynamic DXY gives usually room for consolidations of trends so if in the coming days the DXY is not going to have sudden moves, the bullish Bitcoin trend can be confirmed.

50MA and 200MA are still below the price action. The Daily Golden Cross has been confirmed and the span between the 50 MA and the 200 MA is widening. We managed to see a quick long squeeze just after the Golden Cross and this pattern usually happens because many retail traders are going strongly Long just after the appearance of such a strong signal. So, Institutionals create liquidity to execute their positions and now, they are likely to be Long.

Source: Tradingview - Daily Chart

Ichimoku Clouds are gaining even more width, creating a large area from 20300$ to 22500$, meaning that this can be our next potential support area. That area can act as the next support for a stronger Bullish movement. Besides, the price is getting closer to the upper green part and this is a potential bullish indication itself.

Source: Tradingview - Daily Chart

And now, what from a Volume perspective?

Source: Tradingview - Daily Chart

Volumes have slightly decreased from the last week and this can amplify room for price manipulation, especially in the upcoming weekend. So, even if I am overall bullish, I must pay attention to the next movements and I would also evaluate a lower entrance than this point, to reduce my risk over a Long Position.

What to observe particularly?

Yellow and Blue Areas are confirmed as strong Support/resistances for the price. Volumes are decreasing maning that we may see some manipulation in the next days.

Overall I think that Long is the more probable scenario but I will pay attention to potential lower entry price.

Stay tuned and be sure to follow to get noticed when my contents come out.

Promotional suggestion

One more thing: if you really do not care of technical analysis or you do not like spending time onto the markets, make sure to give a look to the Zignaly platform, an Official Binance Broker Partner with huge volumes under management. They offer great services of Profit Sharing Trading, where you copy other Professional traders, sharing the profit with them! Make sure to give a look!

If you are interested in getting noticed in advanced on the release of our partner’s indicators, leave a comment here so we understand if there is some interest!

None of what I write can represent a financial advice in any form. So Do your own research before taking any kind of action.

Yay! 🤗

Your content has been boosted with Ecency Points, by @mikezillo.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Congratulations @mikezillo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2000 comments.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out our last posts: