Bitcoin Trading Spike as Crypto Sector drives further development

Bitcoin Trading Spike

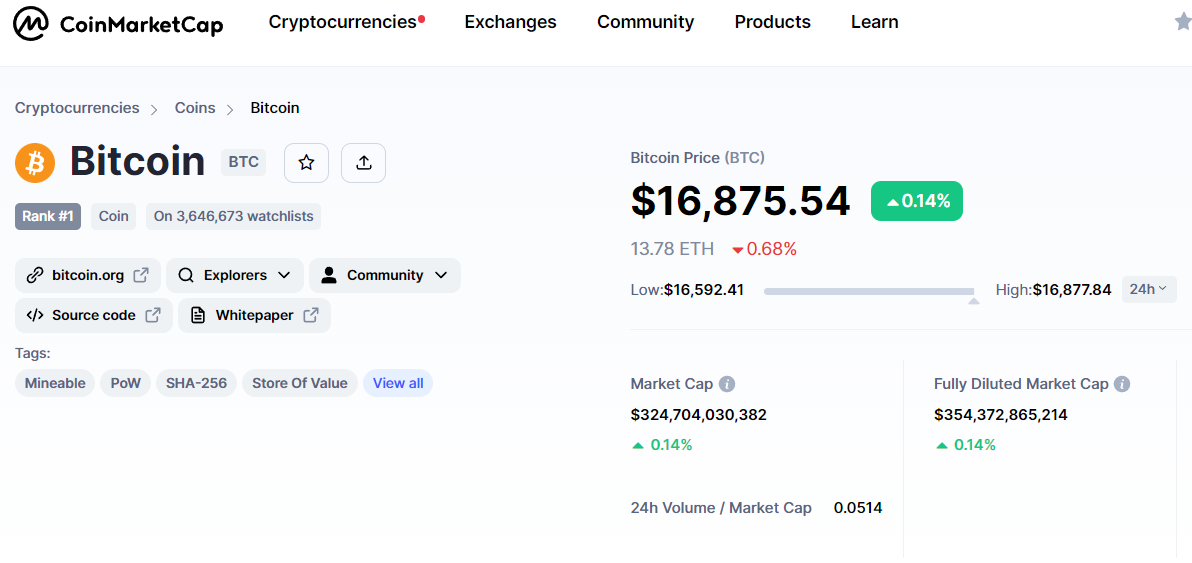

Bitcoin's current price is $US16,861 and back trading in the Green as the original digital asset regains ground despite many calling the decentralised financial era over Bitcoin has managed to turn over $US16 Billion in trading volume within the current 24 hour period indicating a market pick up now that the year is coming to an end.

Bitcoin's price recovery is a telling tail of what 2023 may have in store for the broader crypto market as the outlook is bullish now that interest rates are beginning to stabilize and market confidence returning. 2023 should prove a promising year returning many back to black over the next 12 months as trading volume continues to grow.

Image Source Coinmarketcap

For those calling the Crypto Sector dead the mainstream investors and traders do not see it that way with Mike McGlone pointing out Ethereum was unshaken by deflation and out performed Bitcoin throughout 2022 which is leading to renewed calls of the "flippening" where Ethereum will surge passed the value of Bitcoin.

An interesting tale is Bitcoin Vs Tesla with Bitcoin out performing Tesla indicating that Elon Musk has some real problems a head if he wishes to continue to deliver on his companies Future and retain investors.

Elon, Twitter and Crypto

Twitter continues to drive Crypto integration with Elon tweeting that Twitter users can now call Crypto prices by use of the $ symbol which won't only apply solely to Crypto Currencies and will also enable users to utilise the service for stocks and other financial markets.

Elon has referred to the system as "financial Twitter" and looks like it has already gained traction and support from the broader financial sector, what benefit it will have to the platform and how it will assess which hyperlinks to showcase is yet to be seen.

.jpg)

Years End

As 2022 comes to an end and we begin preparations of the arrival of 2023, many are glad to see this year come to an end with it being one of the worst Crypto performing years since the establishment of digital currencies.

We would like to take a moment to not only reflect on the carnage caused by the many many collapsing crypto initiatives over 2022 and the Billions of lost funds but also all the jobs lost within the sector.

While 2022 provides a window into the wild west of the crypto markets and the dangers they propose, it also showed as a glimpse of how mainstream investors are willing and able to participate in the sector which now leaves the door open for regulation and what ever that may bring, we're sure 2023 will be the year of increased regulatory efforts and investment in the sector.

What's your prediction for 2023? revitalized markets or further pain?

Image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using LeoFinance Beta

https://twitter.com/1291387911238086664/status/1606132348822913025

The rewards earned on this comment will go directly to the people( @melbourneswest ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for the great article and discussion! 😊

It's difficult to predict towards which direction the markets in 2023 will be driven, because although the Fed is going to be easing the pedal on rate hikes, they'll still be ongoing, and there will be lagging effects of the hikes causing (predicted) collateral damage across many businesses. The market may be ahead of these changes, but it's not yet clear how they'll react over the course of the year. Risk-on assets such as cryptocurrencies may recover later than other, more traditional assets.

We also have the unknowns of upcoming worldwide events and the ripple effects of collapsing exchanges and certain cryptocurrencies. At this point, only time will tell what 2023 has in store for us.

However, future years should bring a bit more certainty. For every bear market comes a stronger, long-lasting bull market. Long-term optimism remains very reasonable.

Great comment and while it is difficult to predict we can gain a view with all the mainstream investments

I honestly think it will be further pain. As of right now, the economy is in a bad state and people don't have much discretionary income. So that means that retail won't really be able to push up BTC that much.

Posted Using LeoFinance Beta