Number Go... Up?

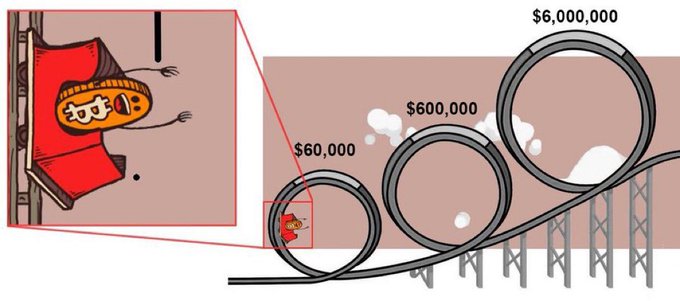

Feels nice to have a green day after so much crab walking. Litecoin above $80. Pretty cool to see such a old-school alt that is essentially an semi-exact clone of Bitcoin still remaining relevant. Many think redundancy in crypto is bad, because redundancy is bad in the legacy economy. In fact in the UK if you get laid off it is often literally said that you're being "made redundant". Centralized corporations can't afford to pay for things that they don't need. They are in the business of extracting value, after all.

This is what happens when people project what they know onto the crypto space. The entire point of decentralization is extremely inefficient redundancy. Why would we do this on purpose? Because the sleek efficient centralized system we built is falling to pieces around us. Evolve or die.

Crypto is more about community than it is about extracting value... or at least ideally this is the case, as there are so many scams out there whose sole purpose is to trick people into thinking they're going to be able to afford that Lambo within a couple months. This is why I always stick close to Hive, even in the middle of the hype cycle. When everyone and their mother was degen gambling on DEFI in 2020 I was like lol I don't have the stomach for that. I've found what works for me and I don't like to step out of my comfort zone. I've been wrecked enough times to realize I need to stay in my lane. Hive and Bitcoin are where it's at.

It's also fun to support products that are built on Hive, but that falls back into the trap of massive centralization. I hope that the Speak Network and HAF technology can alleviate these pitfalls, but that has yet to be proven in the field.

Crystals girls will remind us that a full moon just happened a couple days ago, and mars retrograde ends in a few weeks. If we're lucky the market will be mostly up for a few weeks. Again, it's weird that I've been saying this for months now: the real target is getting above $18k and holding above it for at least a week.

Only then can we even start to think about getting out of the FTX k-hole. $20k is the ultimate "oh shit" unit bias level where all those chuckleheads calling for $10k realize oops not gonna happen. So many bears get flipped bullish on the breakout above $20k; I guarantee it. Lot's of people who shorted the bottom out of panic are gonna lose a bit of their stack, but probably not too bad considering BTC can still go x3 on the next bull-trap.

We're already heading into mid January, but I think we might not see the real moves happen until Feb or March. Speaking of March, summary judgement for the Ripple lawsuit with the SEC is supposed to happen before March 31, so that's also interesting timing.

Personally I believe there is very little downside to Ripple losing the case and extreme massive upside to winning, not only for XRP but the entire market. Of course I've talked about this many times before but the decision just keeps getting pushed back so I feel the need to constantly bring it up. If Ripple wins that's a huge free bull run for everybody.

If the SEC couldn't beat Ripple, then who can they beat?

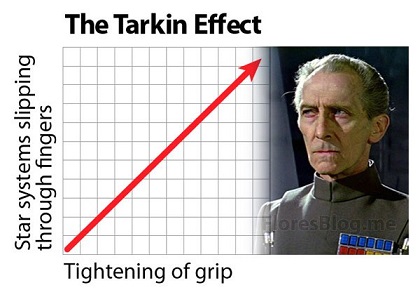

It would be the ultimate sucker punch to the heavy-handed regulations we see attempting to materialize in the wake of 3AC, UST, and FTX. Everyone knows the regulators aren't trying to "protect investors". They want more control and they want to generate fines. That is all. Their purpose has been fully corrupted.

And speaking of corruption, perhaps it's naïve to assume that it's even possible for Ripple to win in the first place. Summary judgement means one person (the judge) decides the outcome. Is it really that hard to "motivate" a single person to make a decision either way? Again, we see the failure of centralized systems pop up even within the very judicial system that was initially designed to provide checks and balances and make society a more fair place. Any research into the judicial system can immediately conclude that it is anything but fair. So we'll see what happens.

Many people seem to be worried that the regulators are going to put a blanket 'ban' on crypto by declaring all altcoins securities. I must admit I don't quite understand the logic there. The SEC will just declare crypto networks securities without even knowing what they are or even looking into how they operate? Hm, good luck with that... lol.

This is comically short-term thinking.

No one wants heavy-handed regulations because that could temporarily cripple the price, but heavy-handed regulations are exactly what crypto needs to flush out the bullshit and keep it out for good. The ENTIRE POINT of this movement was to build product that literally CANT be regulated from an outside authority. Crypto is intrinsically designed to regulate itself by definition. The greed of founders and their premines gets in the way of this. Regulations will put that greed to the grave and bury it where it belongs.

So yeah, Hive being declared a security would be an amazing thing in the long term. We could even fund a lawsuit against the SEC, paid for by @hive.fund, and force them to explain who is in charge of this network and how is it possible to comply with regulations.

Think about it:

It's so obvious that Ripple is in charge of XRP and the Ethereum Foundation is in charge of ETH, so on and so forth down the line. What about Hive? Is Blocktrades in charge? Sure he has a ton of pull, but not really. As far as we know he's not even the biggest stake holder, and even if he was that still doesn't mean he gets to unilaterally make decisions for the network. With the ninjamine locked away in the @hive.fund, no one is truly in charge; it's a joint effort just as it was always intended to be. Even I have people asking for my 'measly' 180k vote from time to time.

Really imagine it though:

A lawsuit with lawyers paid for on our side with DAO money. Would really be the ultimate show of decentralization and showcase the fact that we are not a security. If the SEC was forced to admit openly that Hive wasn't a security in the wake of extreme regulatory overreach, that's an automatic x100 on the price. With a floor increase of around x10. This is the kind of publicity that is invaluable and can't be purchased on a whim like so many other things can.

But it's not going to happen anyway.

For those who haven't noticed, the SEC isn't in the business of destroying crypto. When you invade a country for natural resources, you don't fire off a few nukes first to soften them up. There is no value in lording over an empire of dirt.

Rather the SEC is designed to generate revenue through fees. Crypto is an orchard of low-hanging fruit that the SEC can just walk through and fine whoever is the easiest to fine. What happens next? Most of these these networks continue to operate as usual; a slap on the wrist. They thought Ripple was an easy target; they aren't going to make that mistake again. They'll focus on clearly centralized dev teams that don't have the means to defend themselves but do have the means to settle outside of court. This is simply a product of capitalism. Follow the money.

The only real entities that need to worry about absurd regulations are the banks, and of course by banks I mean exchanges, because they are really just crypto banks. Regulators intimately understand bank regulations, so the ones most under threat by the SEC and other regulatory bodies are places like Coinbase, Bittrex, Kraken, and the like. But even then the option to abandon the country and move to somewhere more crypto friendly is always on the table if things get bad enough. It's good to remember that regulations are not global in nature, even if USA seems to think they get to decide they are in charge of everything.

Conclusion

A green day is a good day. The doomsayers have piped down a bit after being put in their place. Nine weeks of crab-walking will do that to ya. Boring is good. Stability is good. Remember all the cowards still on the sidelines hoping they get the opportunity to dive back in much lower. How often does that actually work out?

I even saw one of the doomsayers on Twitter say "I'm not buying". lol. Okay, buy at a higher price then (it'll be $20k+). So many people think they have this magical edge that doesn't exist. Nothing about the situation we are in is predictable, but the long term outcome is inevitable. When it doubt: zoom out.

Posted Using LeoFinance Beta

I know what you are saying. If the last bull and this current bear have taught me anything, it is that I need to stick with what works. For me, Hive has worked far better than just about any other crypto investment I have made. I need to carry that forward with me.

Posted Using LeoFinance Beta

💯 that’s going to pull some mad PR, I would be so proud lol!

Again 💯, captures my thoughts and long term plans.

Hopefully Shit CEX’s are done collapsing, then these green candles might just stay a while

Posted Using LeoFinance Beta

I have mixed feelings about CEX collapsing...I feel they provide structure for the market. But I could be wrong the initial intent for the crypto market was not supposed to one with central forces.

DCA the safest way to play it right now. Buying BTC at 16K 12K 15K makes little difference when you can sell in a few years at 69K or even higher. I am nut sure if that’s the bottom but everything under 20 K is free moneyzzz

Boom! That just happened.

Posted Using LeoFinance Beta

The same mentality, waiting for 100K to sell and waiting for 10K to buy. I can wait to sell... I certainly don't mind buying down here.

Interesting post on several topics. I like the concept of cryptocurrency POW being inefficient redundancy by design. That encapsulates the concept well.

Posted Using LeoFinance Beta

Funny how you called Coinbase a crypto bank and today they are laying off their workers like the other companies. I think we will see more of this over the next couple of years.

I wrote a post all about them laying off their workers here

I am one of those. Regulators don't operate on the basis of reason. What matters to them ultimately is force. And if it's really true that crypto by its very nature cannot be regulated, it's good to see the outcome of such a fight.

I think you're right. Regulators are more concerned with extraction rather than regulation.

In that case, the regulators have to do the impossible to enforce their will.

Posted Using LeoFinance Beta